A "how-to" guide to Valuabl

How to read, understand, and interpret the valuations and research on Valuabl. An overview of my valuation process.

Many of you have asked for a guide on reading, understanding, and interpreting my valuations and research. This page is that guide.

The Valuation Process

When estimating the intrinsic value of a stock, I take the following approach:

Step 1: I estimate the value of the operating businesses, the non-operating investments that the company has, any real options, and cash & equivalents.

Step 2: I estimate the value of the priority claims on the assets. These claims include financial and operational debts, preferred equity, non-controlling interests, and outstanding options.

Step 3: This leaves me with the residual value that is leftover for the common equity shareholders. I divide this by the total number of common shares outstanding (including RSUs), which gives me my estimate of the intrinsic value per share.

The central part of this process is valuing the operating business. I will focus there:

Operating Business Valuation

To value the operating business, I use the process of DCF valuation. I forecast future revenues, margins, taxes, and reinvestment needs to derive Free Cash Flows to the Firm. I then discount these at the Weighted Average Cost of Capital to get the value of the operating business.

Story — I look at where the company has come from, what they’re doing now, and their plans for the future. Using this, I write a small story about the future of the business.

Then, with that story in the front of my mind, I go through and estimate all the valuation drivers. Each lever has to fit my story. If it doesn’t, either my story or the driver needs to change. The valuation process is reflexive.

Growth Forecasting — I look at six main things to estimate revenue growth:

Size of the Total Addressable Market (TAM).

Market share the company has.

Competitive advantages that the company has.

Economists forecasts of market growth.

The fundamental growth rate (Reinvestment x Return on Capital).

Analyst consensus for growth.

For younger growth companies, I focus more on TAM and Market Share. I focus more on the fundamental growth rate and economists’ forecasts for market growth for more stable and mature companies.

I estimate a growth rate and use analyst consensus growth rates as a sanity check.

Margin Forecasting — I look at five main things to estimate future margins:

Current company margins.

Historical company margins.

Industry average margins and the distribution of those margins.

Competitive advantages the company has or is building.

Cost/pricing structure and changes over time.

For younger growth companies, I tend to focus more on the industry average margins, the distribution of those margins, and how strong I think the company’s competitive advantages are. For more stable and mature companies, I focus more on the current and historical company margins, the durability of competitive advantage, and how the cost/pricing structure changes over time.

Tax Rates — I maintain a dataset of tax rates for (almost) every country. I weigh these rates by constant-currency GDP to get tax rate estimates for regions and a global estimate.

I usually assume that the company’s tax rate will transition from the current underlying effective tax rate that they are paying towards the underlying marginal corporate rate across the country’s segments.

If the company’s current effective rate doesn’t make sense, I will use my estimate of the company’s underlying marginal rate.

If the company has Net Operating Losses that will act as a tax shield, I consider them here.

Reinvestment Required — To forecast how much capital the business will need to reinvest for growth in any given year, I use a revenue efficiency ratio to determine how efficiently the company turns invested capital into revenue. I compare this to industry averages, decide how efficient the company is and how effectively it will reinvest capital to achieve the growth forecast. As a general rule of thumb:

Organic Growth Focused — Bias towards company revenue efficiency.

Inorganic/Acquisition Focused — Bias towards industry average.

I always assume that maintenance CAPEX will be equal to D&A. Growth CAPEX is estimated using the above method.

Weight Average Cost of Capital — There are tomes written on this subject. The important thing is to be as specific as possible while not getting lost amongst the reeds.

(I will probably come back and flesh the details here out over time)

Cost of Equity — I use the CAPM and estimate the inputs as follows:

Risk-Free Rate: I start with the 10-year government bond yield in the currency I decided to value the business. I then subtract the default spread based on the Government’s credit rating and aggregated sovereign credit spreads for that rating.

Beta: I estimate the 5-year average ‘product/service beta’ for the region-specific industries that the company is in (this is a dataset I maintain taken from 50k+ public companies). I then take a weighted average of the betas fr the industries and markets that the company operates in, lever these for the company’s operational leverage, and lever this for the company’s financial leverage.

Equity Risk Premium: Each month, I estimate the implied ERP for the United States by using analyst consensus estimates to value the S&P500 and back out the implied ERP. I then add to this weighted country risk premiums based on the geographies in which the company operates. I estimate a specific country’s premium by taking the sovereign credit rating for the country, looking up the implied default spread, and multiplying this by the relative volatility of non-US equity indices over non-US sovereign bonds.

Cost of Debt (After Tax) — I use the risk-free rate + default spread method.

Debt Rating & Default Spread: If the company has traded bonds, I use the YTM on those bonds as the cost of debt. If the company doesn’t, I look up the official credit rating and attach a default spread based on the average default spread for corporate bonds with that rating. If it doesn’t have a rating, I assign a synthetic one based on the interest coverage ratio (backwards, current, or forward) depending on the current situation and average interest coverage ratio by credit-rating data from S&P. If the company is small and only operates in a single country, I assign an additional country default spread based on the country’s sovereign spread.

Tax Rate: Underlying estimated marginal tax rate.

Preferred Equity — The cost of preferred equity is the dividend coupon paid divided by the principal. Preference shares are hybrids trapped between being equity and debt.

Debt/Equity Ratios — If the company’s debt is publicly traded, I use that. If not, I estimate the NPV of the debt using the pre-tax cost of debt. I use the company’s market capitalisation for the Equity Value.

Convertible Debt — If the company has convertible debt, I break it into two components and treat them separately. I break it up into the pure debt component, lump it in with the Financial Debt, and extract the options component. The optionality typically serves to lower the cost of debt by transferring the value difference caused by the cost reduction into an option.

Stable Value — I use the Perpetual Growth Model to estimate the Stable Value of the company. Stable value involves some key assumptions:

The perpetual growth rate is always less than or equal to the risk-free rate. Assumption prevents letting the company grow faster than the economy forever. Again, tomes have been written on this.

The reinvestment needs for the company will be proportional to the excess returns the company can generate in perpetuity. For safety, I generally assume that the company’s return on invested capital will be equal to its cost of capital in perpetuity.

Other Bits & Pieces —

Research & Development: If the company conducts R&D, I treat this as capital reinvestment and capitalise the R&D spend. I do this by looking up accounting D&A schedules for the particular industry, going backwards that many years and treating all the R&D in that time as a capital expense.

Operational Leases: Under IFRS16 and GAAP, these have mostly come on book, but if they haven’t, I capitalise the leases by treating the future leasehold commitments as debt.

Sales & Marketing: If the company is heavily brand focused and derives significant value from its brand, I will capitalise the S&M spend like R&D.

Investments Valuation

If the investments are carried at fair value on the balance sheet, I have little choice other than to go with what the accounts have estimated. If the investments are carried under the equity method, I usually value them using an industry average PB multiple. Ideally, I would value each asset separately, but disclosures rarely have enough data. This method is a workable solution.

Real Option Valuation

If the company has patents, undeveloped mining rights, branding rights, or anything else that can be considered a real option, then I value those separately using the Black-Scholes model. In that case, I use the current cost of development, the NPV of FCF from developing the asset now, and the underlying volatility of either the business line or commodity.

(I will probably come back and flesh the details here out over time)

Cash & Equivalents Valuation

If the company has a claim to the cash and doesn’t have any trapped overseas that would be subject to taxes upon repatriation, I assume that the cash and short-term liquid securities are worth their market value.

If the cash is trapped overseas and subject to a repatriation tax, then I’ll look at the particular details and use my best judgement.

Financial Debt Valuation

If the financial debt is traded, I use the market price. If not, I estimate the NPV of the debt.

Operating Lease Debt Valuation

I estimate the NPV of the leasehold commitments.

Non-Controlling Interests Valuation

As with investments carried under the equity method, I take the book value and multiply it by the prevailing industry average PB ratio. It’s not perfect, but it’s the best we can do.

Non-Controlling Interests (sometimes called minority interests) are the parts of the non-operational businesses that have been consolidated entirely into the company’s financial statements. i.e. this is income and capital that someone else owns but that the company has consolidated.

Employee & Convertible Options Valuation

I use the Black-Scholes, the number of options and equivalents, the weighted average strike price and maturity, the stock price volatility, and the current dividend yield.

Common Shareholders Equity

After all this, I get the total value of the equity that the common shareholders own. Here, I divide by the total number of shares outstanding (common shares and restricted stock units) to get the intrinsic value per share.

Sensitivity Analysis

When forecasting the future, every estimate I make will be wrong. By this, I mean that there is an almost 0% chance that all of my estimates will play out precisely to the number.

The future is uncertain. So, how do we deal with that uncertainty?

Typically, the strategy is to apply a margin of safety to the valuation. If you estimate the stock worth $100, if your margin of safety is 10%, you would be willing to buy it below $90.

But, the future is more uncertain for some companies than for others, and there is a much wider range of outcomes.

A young growth company in a frontier market has a highly uncertain future with many potential outcomes.

A mature utility in a developed market has a more certain future with a tighter range of potential outcomes.

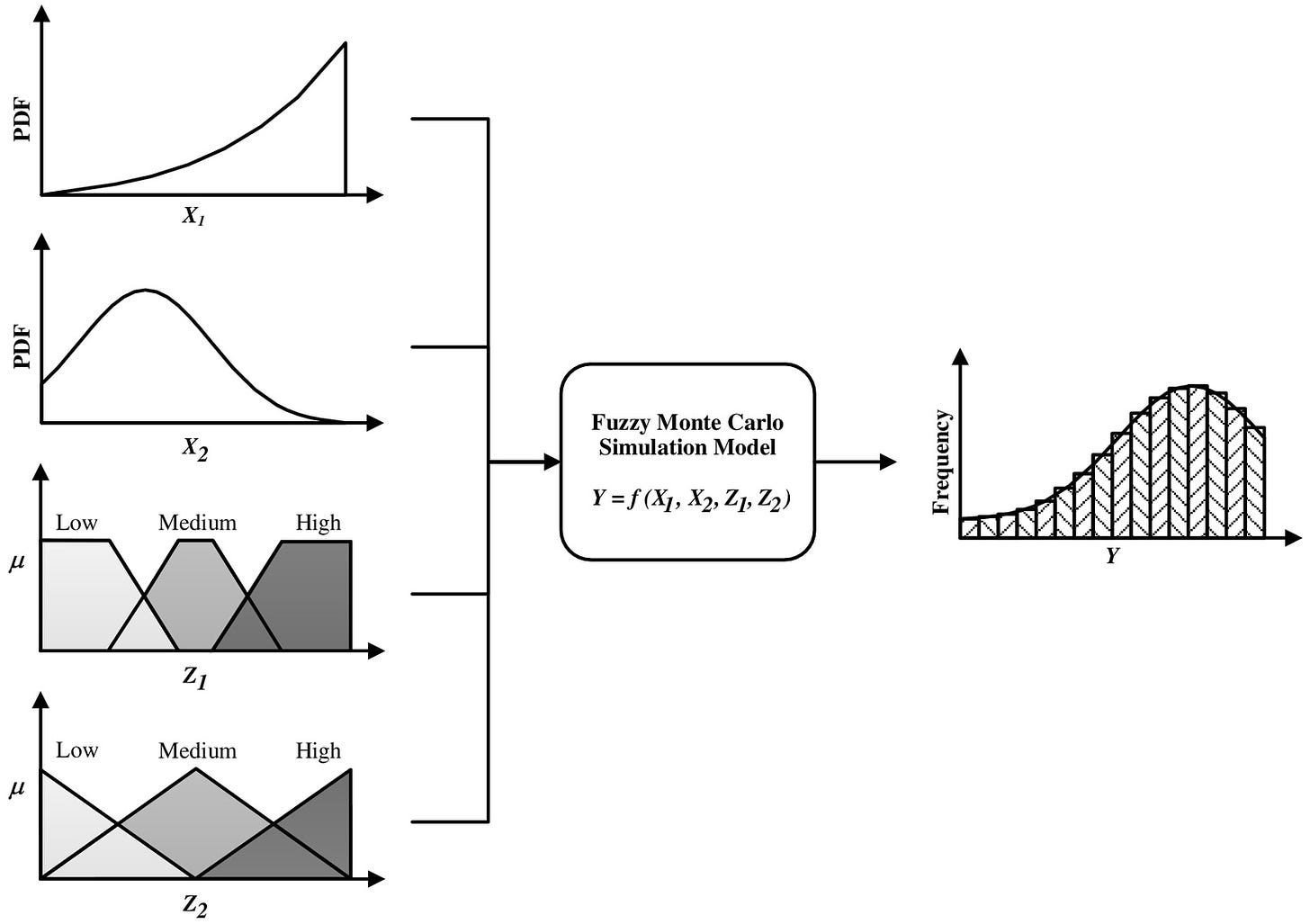

To tackle this, I use Monte-Carlo Simulation. Monte-Carlo simulation is a process in which inputs to the valuation model are defined as being randomly drawn from distributions. A sample from each distribution is taken and put into the model, the model computes the output valuation, and this result is recorded. This process is run tens of thousands of times, and distribution of output valuations is built.

In essence, it is a What-If analysis run many times with a defined distribution for each variable. I choose a few of the main inputs that will drive the value outcomes (usually growth, margins, capital efficiency, and capital costs) and run 10k simulations.

Market Price & Rating

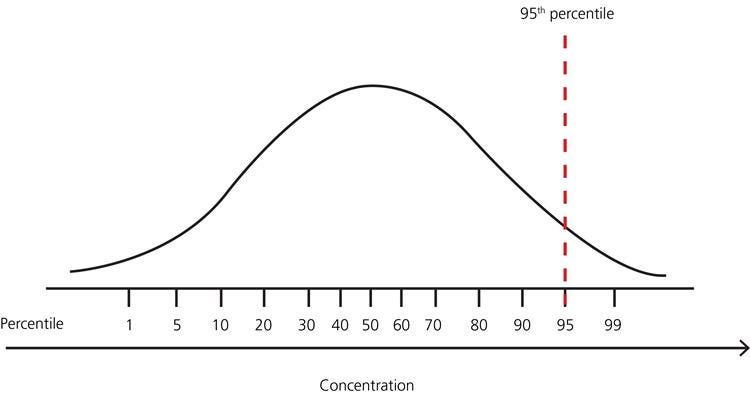

After I have a distribution of intrinsic values, I compare the market price to that distribution and assign a rating based on how likely the stock is to be under/overvalued. I do this by calculating what percentile the price is on the valuation distribution.

For example: If the current price is at the 95th percentile, then based on our model and sensitivity analysis, in 95 % of scenarios, the intrinsic value will be less than the current price. This outcome suggests that there is an excellent chance the stock is overvalued.

My Rating Percentiles:

<10% = Buy

10% - 25% = Add

25% - 75% = Hold

75% - 90% = Reduce

>90% = Sell

The final thing to say is that I act on all my ratings if there is a correlation/return benefit.