The trillion-dollar man

Jamie Dimon is getting closer to retirement. He will go down as one of the best bankers of the modern era.

Finance | Jamie Dimon has done an incredible job

Last year, JPMorgan Chase, a prominent American bank, reported the fattest annual profit of any bank in the country's history. The financial behemoth made $49.6bn in after-tax profit, or more than $1,500 per second. Unsurprisingly, the bank's long-serving boss, Jamie Dimon, got a raise from the board. Last year, the bank paid him $36m, comprising $1.5m in salary, $5m in cash, and $29.5m in shares.

As he's earned and bought so much JPMorgan stock during his tenure, he's now a billionaire. He’s also probably getting ready to retire soon. For the first time, he started to sell some of his JPMorgan stock last year. But what has his record been like, and does he deserve the cash he got? Jamie Dimon's record at JPMorgan can be described in one word: outstanding.

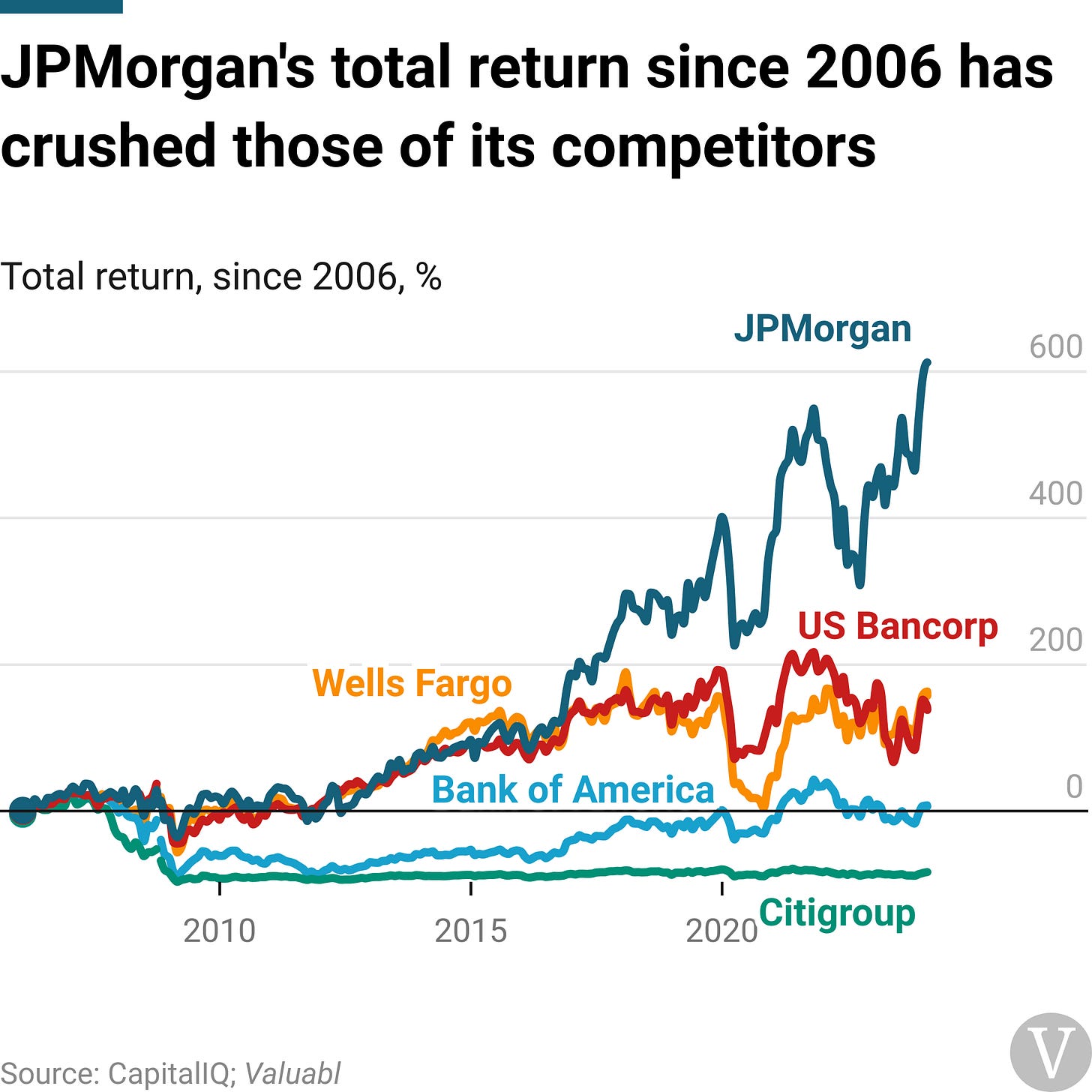

The first reason Mr Dimon's record has been so good is that he's overseen incredible, industry-leading shareholder returns. Consider this: if you had bought the bank when he became the boss in 2006, it would have cost you $141bn. In the 18 years since then, JPMorgan's equity has produced a 612% total return, including dividends. Your investment would now be worth over $1trn. That makes Jamie the trillion-dollar man.

Although a 12% annual return doesn't sound all that impressive, it's genuinely enormous compared to the bank's competitors. In contrast to JPMorgan, Wells Fargo returned a lazy 157% over that same time, while US Bancorp made just 138%. But even these are far better results than the rest. Bank of America investors made just 6% in those 18 years, while Citigroup shareholders lost their pants with an 83% loss. Mr Dimon and JPMorgan haven't just produced excellent returns; they've trounced their competitors and made shareholders rich.

The second reason is that Mr Dimon has transformed JPMorgan into a lucrative bank with a fortress balance sheet. Since taking the helm, he has doubled the bank's net income margin from 17% to 34% and return-on-equity from 8% to 16%. At the same time, he has improved the bank's core tier 1 capital ratio, a fancy measure of leverage, from 7% during the global financial crisis (GFC) to 15% today. That's the highest of all American banks with a market capitalisation over $10bn. It also means the bank has more than twice the shock-absorbing strength it did back in 2008.

These improvements in profitability and leverage have led to massive value creation for shareholders. Valuabl estimates the firm's average cost of equity since Mr Dimon took over as boss has been 9%. However, the firm has produced a 12% compounded annual shareholder return—an annual 3% excess return. If the bank had instead only made a return equal to its 9% cost of equity, then shareholders would have $717bn today instead of a trillion. Jamie has overseen the creation of $284bn of excess value in the 18 years he's been the boss or $16bn per year. His $36m of compensation last year is a steal by comparison.

Third, Mr Dimon has smoothly navigated and grown the bank through financial crises and comprehensive regulatory changes. Under his leadership, JPMorgan has survived and thrived through the GFC, the European debt crisis, regulatory changes from Dodd-Frank and the Basel reforms, the covid19 pandemic, and the American bank runs early last year.

He's grown the bank's total assets from $1.3trn to $3.9trn by attracting new business and acquiring distressed competitors at opportunistic times. These buys include Bear Stearns and Washington Mutual, two former Wall Street giants, during the GFC. And coming out the other end of all these crises, JPMorgan is now the largest public bank in the world by market capitalisation and fifth largest by total assets. The four larger banks are all state-backed Chinese banks. Jamie Dimon is one of the most outstanding bankers of the modern era.

"Adventure is the life of commerce, but caution is the life of banking." — Walter Bagehot. ■