Vol. 2, No. 10

On the cost of capital. Regional equity valuations. No, stocks aren't cheap yet. Corporate shuffleboard. Credit creation, cause & effects. Valuing chocolate and cardboard packaging businesses.

Valuabl is an independent, value-oriented journal of financial markets. Delivered fortnightly, Valuabl helps investors pop bubbles, buy low, and sell high.

HOUSEKEEPING

In the last issue (Vol. 2, No. 9, Credit creation, cause & effects), the ‘Movement of the yield curve’ and ‘Federal funds target rate market forecast’ charts were switched. Sorry.

In today’s issue

Cartoon: Money vacuum go VRRRRR

The cost of capital (4 minutes)

A global stocktake (3 minutes)

No, stocks are still not cheap (7 minutes)

Corporate shuffleboard (3 minutes)

Credit creation, cause & effects (9 minutes)

Requested valuations (11 minutes)

Investment ideas (15 minutes)

Cartoon: Money vacuum go VRRRRR

The cost of capital

Interest rates and capital costs are the most consequential yet misunderstood prices in capitalism, connecting the future to the present.

•••

Equity markets crumbled again last fortnight. Investors wiped $6.9trn from global stock prices (see: 'A global stocktake' below). In a sign of the times, Saudi Aramco, a gargantuan Saudi Arabian oil pumper, overtook Apple as the world's most valuable company. The S&P500, an index of large American companies, was down another 5.9% to 3,935. The index has fallen 17.5% from the start of the year and is now at its lowest level since March 2021.

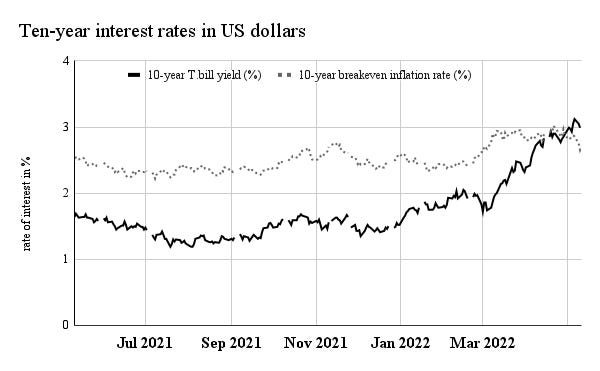

As equities fell, so too did government bonds. Yields, the inverse of prices, marched higher as investors digested stubbornly high inflation data and central banks stayed hawkish. The yield on ten-year US Treasury bills, a key rate for valuing financial assets, rose by 17bp. Real rates, the difference between yields and expected inflation, turned positive for the first time since the pandemic began. Bond buyers can now expect to increase their purchasing power by 34bp per year—an insipid proposal, but less chilling than losing it—happy Friday the 13th.

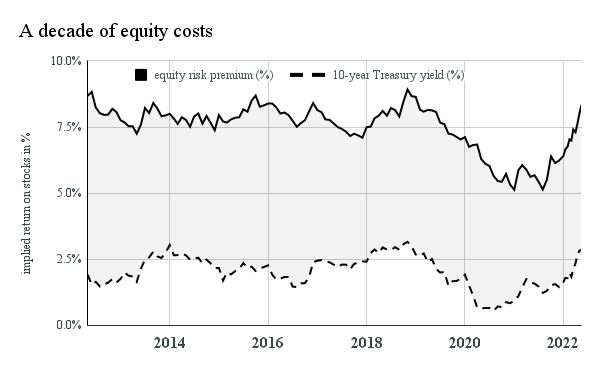

The equity risk premium (ERP), an estimate of the extra return investors demand to buy stocks instead of government bonds, rose by 28bp. The current premium, 5.49%, is the highest since the peak of the panic in early-2020 and higher than the average of the last five years. Equity investors' fear is rising.

Returning from their pilgrimage to Omaha, prospective value investors are likely to have the Oracle's words fresh in their minds, "be fearful when others are greedy and greedy when others are fearful." After watching stock prices tumble, they might reckon that stocks have finally become cheap—they are not. Stocks are not cheap; instead, the cost of equity is normalising, and stocks are just not as expensive as they have been for the last two years (see: 'No, stocks are still not cheap' below)

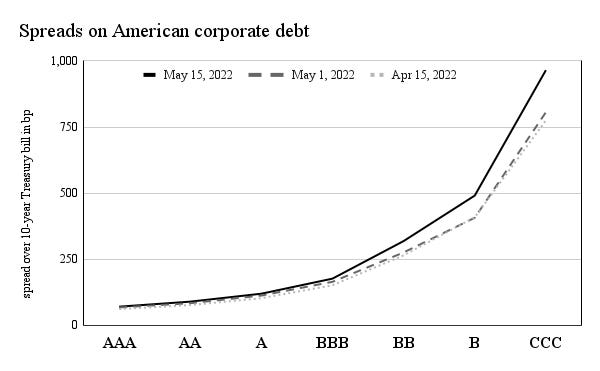

Equity investors aren't the only ones feeling more anxious. Creditors do too. The average corporate credit spread, the difference between corporate and government bonds yields, rose by 45bp. Spreads for riskier companies increased by more than safer ones as investors continue to expect rising interest rates to debilitate struggling firms' ability to make interest payments and refinance.

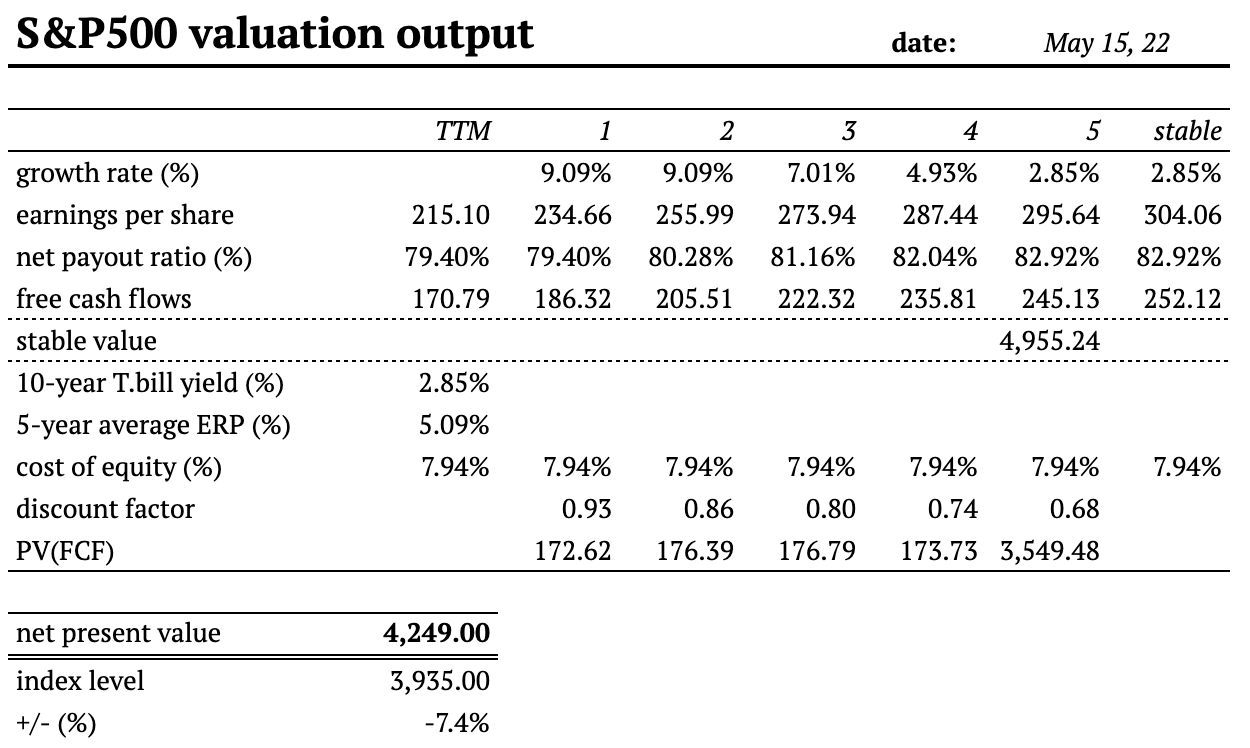

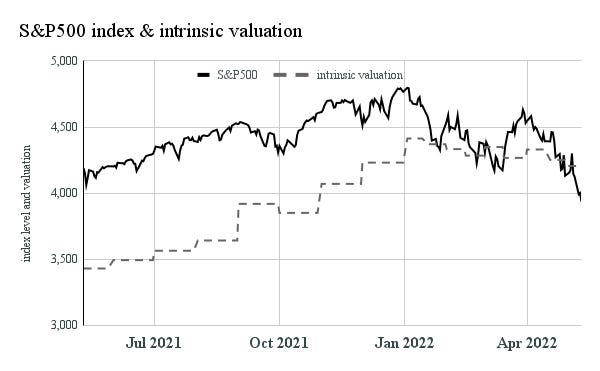

Using the average ERP of the last five years, the current ten-year Treasury bond yield, analysts' consensus earnings estimates, and a stable payout ratio based on the S&P500's average return on equity over the last decade, I value the index at 4,249 compared to its level of 3,935.

This valuation suggests the S&P500 index is now 7% undervalued compared to 9% overvalued at the start of the year and 22% overvalued 12-months ago.

READY FOR MORE?

This is the end of the free portion of Valuabl. To access all issues and support independent research, consider becoming a paid subscriber.