Vol. 2, No. 12

On the cost of capital; Corporate bosses are lousy judges of value; Equities are still overpriced; Countries with the most deleveraging risk; Disinflation will be more Volcker-like than we expect.

Valuabl is an independent, value-oriented journal of financial markets. Delivered fortnightly, Valuabl helps investors pop bubbles, buy low, and sell high.

In today’s issue

Cartoon: Our forever home

Cost of capital (4 minutes)

Global stocktake (3 minutes)

Corporate shuffleboard (2 minutes)

Credit creation, cause & effects (8 minutes)

Debt cycle monitor (2 minutes)

Investment ideas (15 minutes)

Bagehot on the effects of central bank stimulation

“In all business this is well known by experience: a stimulated market soon becomes a tight market, for so sanguine are enterprising men, that as soon as they get any unusual ease they always fancy that the relaxation is greater than it is, and speculate till they want more than they can obtain.”

—Walter Bagehot, Lombard Street: A description of the money market, 1873

Cartoon: Our forever home

Cost of capital

Interest rates and capital costs are the most consequential yet misunderstood prices in capitalism, connecting the future to the present

•••

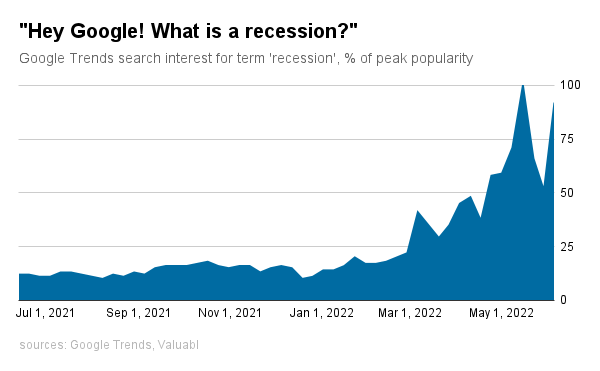

It's hard to escape predictions of a recession. Economists, government officials, and large banks—whether or not we should listen to them is a debate for another time—are proclaiming that a downturn is coming. Three-quarters of bosses of Fortune 500 companies reckon tough times lie ahead as the Federal Reserve tries to wrestle inflation under control by raising rates. Google searches for 'recession' are surging.

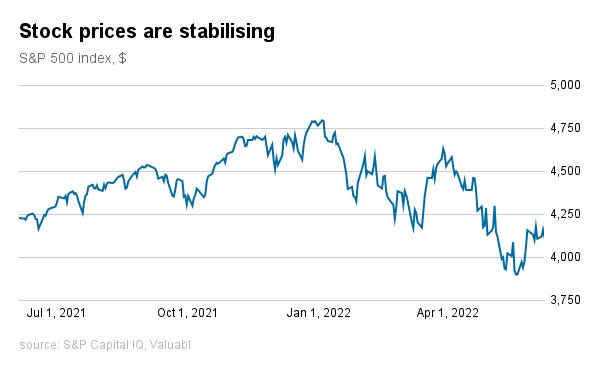

Despite the doom and gloom, stock markets climbed again last fortnight. The S&P 500, an index of big American companies, rose by 3%, while the market value of all public companies worldwide grew by 4% (see: 'Global stocktake'). The index is down 14% since January, its peak, and 2% over the last year. The previous overvaluation of stocks and recent normalisation of capital costs are to blame, rather than expectations of earning growth decline. Analysts' consensus estimate for the index's earnings per share (EPS) for 2023 was $245.37 on January 1 but is now $251.55. Earnings expectations continue to move higher despite recession murmurings.

Government bonds fell as stocks rose. Yields, which move inversely to prices, rose as inflation expectations increased. The yield on the ten-year Treasury bond, a key variable for valuing financial assets, rose by 23bp. The real interest rate, the difference between yields and expected inflation, is barely above zero. Bond investors can expect to increase their purchasing power by 20bp per year. This tepid return is better than it was a year ago but is so low that it would take almost 347 years to double your purchasing power.

The equity risk premium (ERP), the extra return investors need for buying stocks instead of bonds, fell by 30bp. The current premium, 5.2%, is comparable to its average over the past five years of 5.1%. The premium has risen by 43bp since January and 110bp since last year.

The cost of equity, the return stock-investors demand to part with their money, is 8.2%, down 1bp from last fortnight when Valuabl last went to press. It is consistent with its average over the past decade.

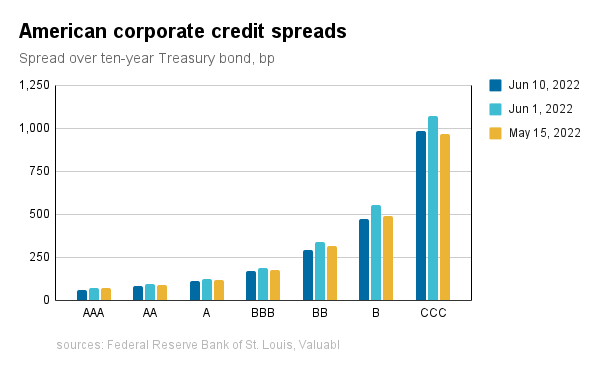

Creditors also marked down risk last fortnight. Corporate bond prices rose more than government ones. Credit spreads, the difference between corporate bond yields and Treasury yields, shrank by 38bp on average, with the riskier end falling by more. CCC-rated corporate bond spreads fell 89bp compared to a 17bp contraction in spreads for BBB-rate ones.

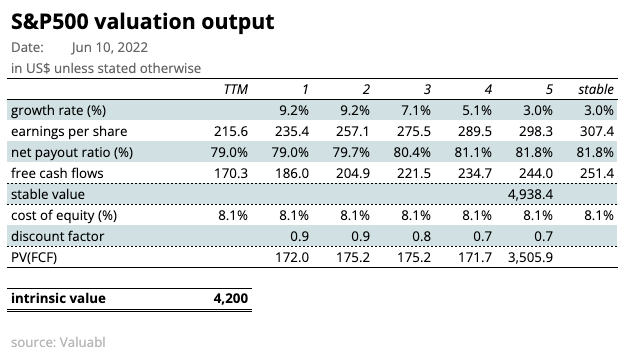

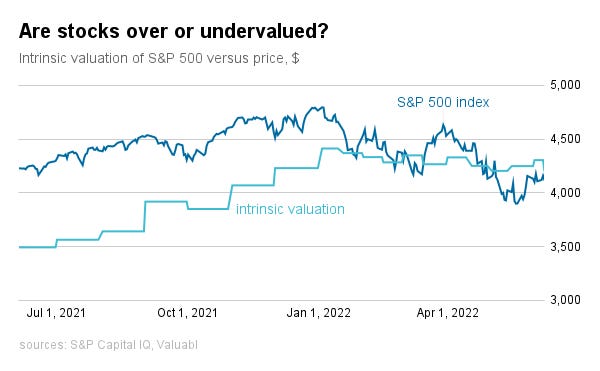

Using the average ERP of the last five years, the current ten-year Treasury bond yield, analysts' consensus earnings estimates, and a stable payout ratio based on the S&P 500's average return on equity over the last decade, I value the index at 4,200 compared to its level of 4,116.

This valuation suggests the S&P 500 index is 2% undervalued compared to 9% overvalued at the start of the year and 20% overvalued last year.

READY FOR MORE?

This is the end of the free portion of Valuabl. To access all issues and investment ideas, and support independent research, become a paid subscriber now.