Vol. 2, No. 5

The cost of capital. The price of Putin. Corporate shuffleboard. Taylor’s rate is making a comeback. Credit creation, cause & effect. Investment idea: an undervalued European grocer.

Valuabl is an independent, value-oriented journal of financial markets. Delivered fortnightly, Valuabl helps contrarians pop bubbles, buy low, and sell high.

In today’s issue

The cost of capital (5 minutes)

The price of Putin (5 minutes)

Corporate shuffleboard (3 minutes)

Taylor’s rate is making a comeback (4 minutes)

Credit creation, cause & effect (7 minutes)

Investment ideas (19 minutes)

Dinner at the Putin’s

The cost of capital

Interest rates and capital costs are the most consequential yet misunderstood prices in capitalism, connecting the future to the present.

U.S. stocks fell again last fortnight. The S&P500, an index of U.S. stocks, traded at 4,402 on February 14 and had fallen 0.6% to 4,373.94 by March 1. The index is down 8.2% for the year but up 13.6% over the last 12-months. On February 24, Russia launched a large-scale invasion of Ukraine, one of its neighbours to the southwest. It marked a significant escalation between the countries which have been in a state of conflict since 2014.

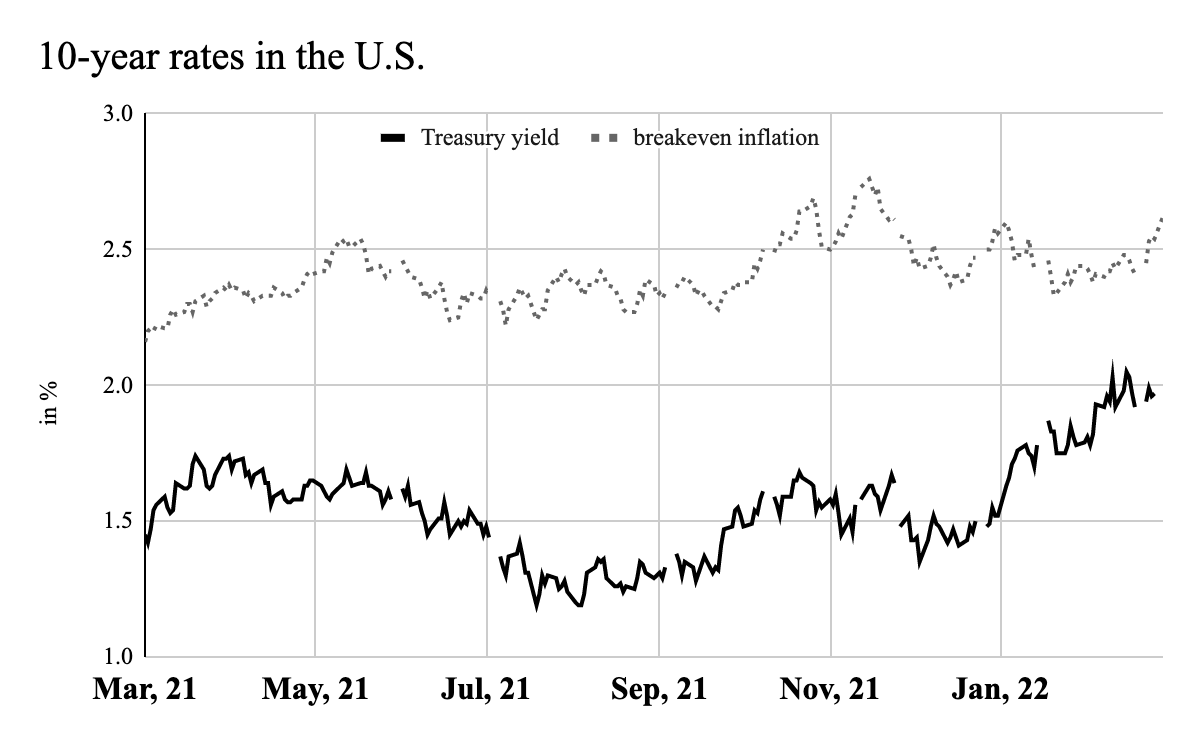

The yield on the 10-year Treasury bond also dropped. It decreased by 15 basis points (“bp”) last fortnight, going from 1.98% to 1.84% when the price of the bonds rose as investors sought investment safety in response to Russia’s aggression and international sanctions that followed. Despite their drop, yields are still up 40bp in the last 12-months. In contrast, the 10-year breakeven inflation rate increased by 14bp to 2.62%, driving expected real risk-free returns down to -0.78%. Investors in Treasury bonds are still willing to lose money over the next decade in real terms.

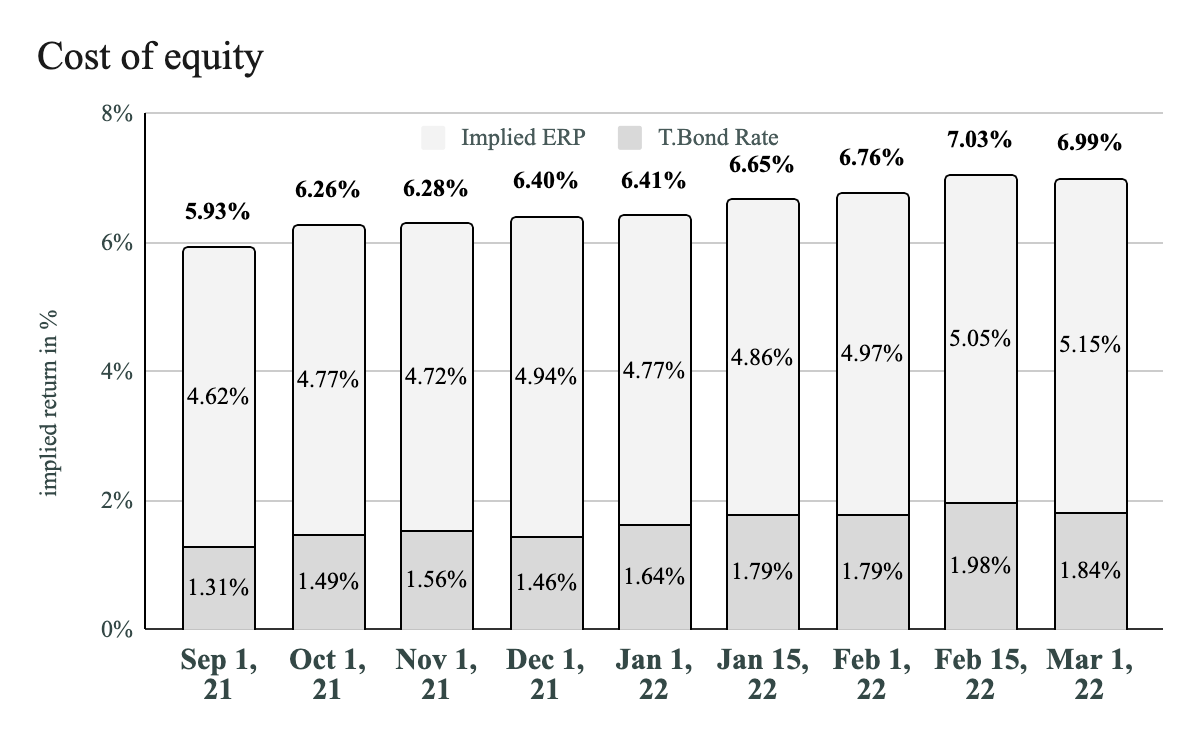

The equity risk premium (“ERP”), the excess return that investing in the stock market provides over a risk-free rate, rose by 10bp from 5.05% to 5.15%, the highest level since 2019. Equity investors now demand 72bp more to invest in stocks, rather than Treasuries, than they did 12-months ago when the ERP was 4.43%. The cost of equity—or the implied return—for U.S. stocks decreased by 4bp from 7.03% to 6.99%. Despite the slight decline, equity still costs 113bp more than it did 12-months ago.

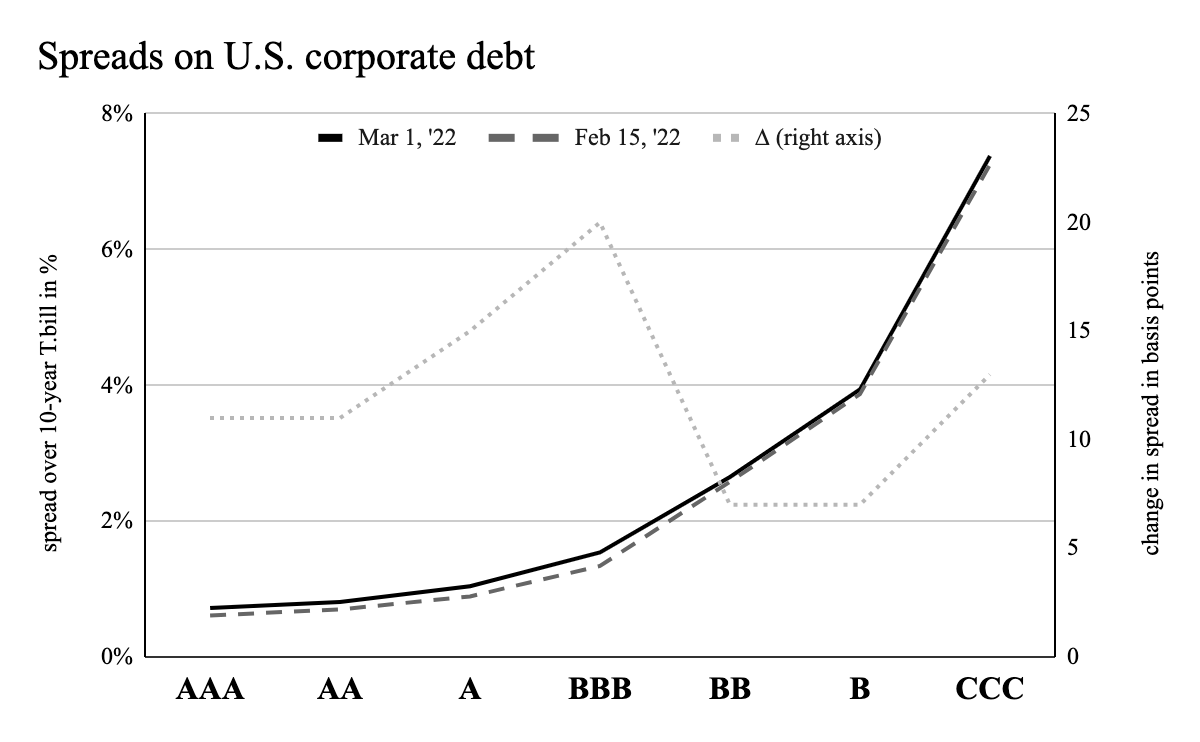

The spreads on U.S. corporate debt over 10-year Treasury bonds rose again, too—rising 12bp on average. Spreads on BBB rated bonds rose by 20bp, the most, while AAA spreads rose by 11bp and CCC by 13bp. While these rises mostly offset the decline in Treasury bond yields, they signal that investors perceive debt securities as riskier than a fortnight ago.

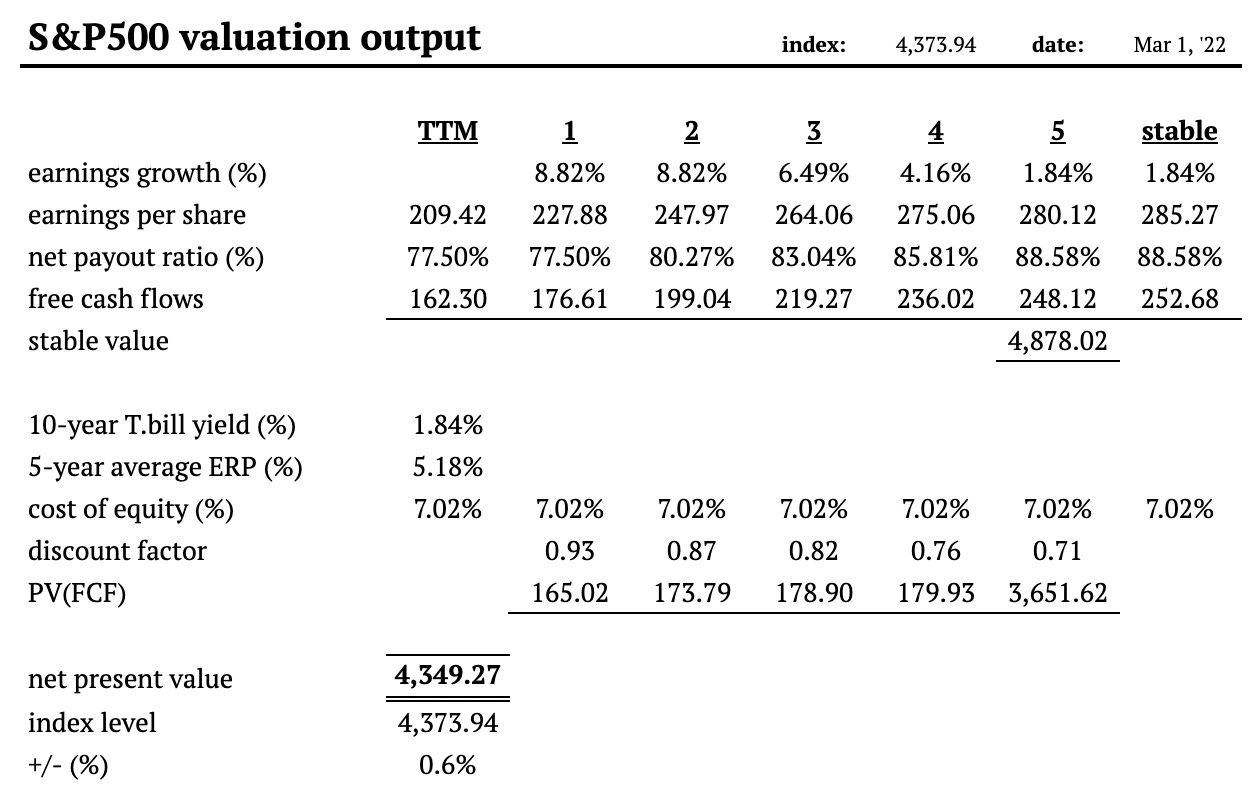

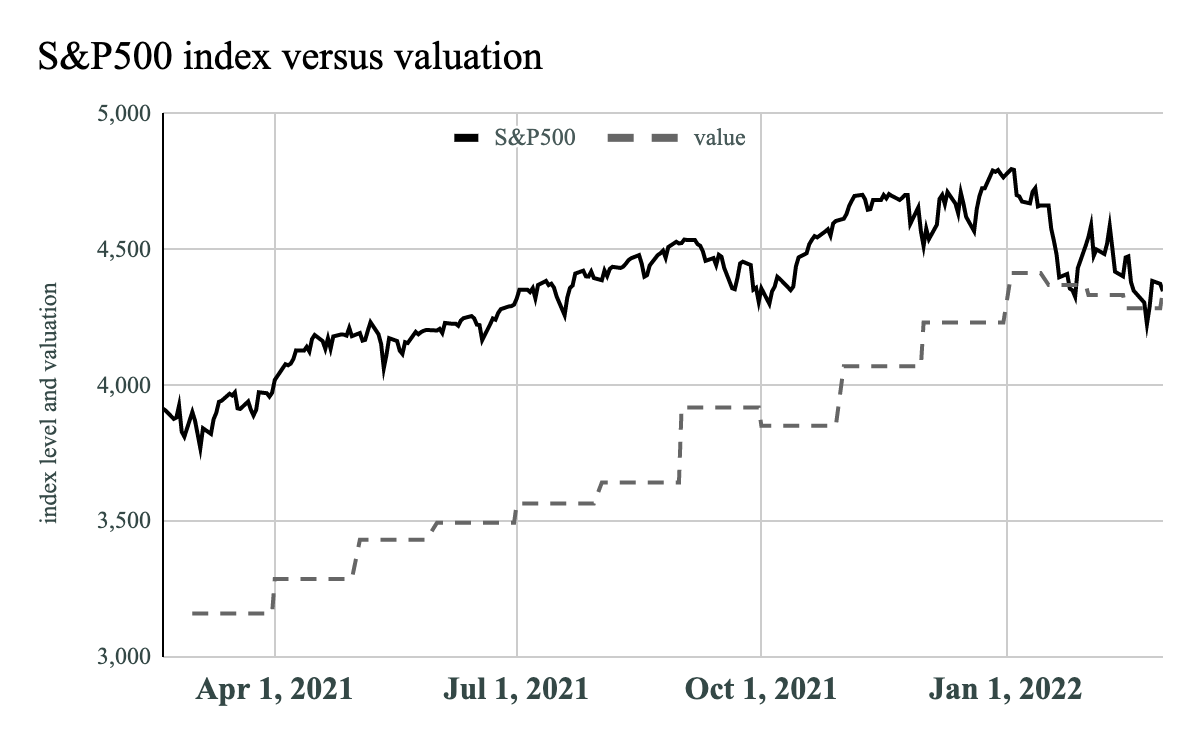

Using the average ERP of the last 5-years, the current 10-year T.bill yield, analysts’ consensus earnings estimates, and a stable payout ratio based on the S&P500’s average return on equity over the last decade, I value the index at 4,349 compared to its level of 4,374.

The price of the S&P500 index has, since the start of the year, declined rapidly towards my intrinsic value estimate. This valuation suggests it is just 0.6% overvalued compared to 8.0% at the start of the year and 20.6% 12-months ago.

READY FOR MORE?

Valuabl is a reader-supported publication. To receive new issues and support independent research, consider becoming a free or paid subscriber.