Vol. 3, No. 3 — Oh, the humanity!

A short-seller's report threatens one of India's largest companies. African stocks look cheap. An economic slowdown is imminent, and the monetary policy will shift. Value in Mexican chicken.

Welcome to Valuabl, a twice-monthly digital newsletter providing rigorous, value-oriented analysis of the forces shaping global capital markets. New here? Learn more

In today’s issue

Cartoon: Gilets Jeunes

Oh, the humanity! (2 minutes)

Cost of capital (3 minutes)

Global stocktake (3 minutes)

Rank and file (1 minute)

Credit creation, cause and effects (8 minutes)

Debt cycle monitor (2 minutes)

Investment idea (15 minutes)

“For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favourable business developments.” — Warren Buffett

Cartoon: Gilets Jeunes

Oh, the humanity!

A short-seller’s report could cause one of India’s most prominent corporate airships to crash and burn.

•••

Last week, the drolly named Hindenburg Research, a short-selling activist investor, published a report on the Adani Group, a prominent Indian conglomerate, alleging fraud. Their 35,000-word report came after two years of investigation and laid out how they reckon Gautam Adani, the founder and boss, and his family have conned investors. Hindenburg says the Adani family manipulated the market and lied about accounts to boost the price of companies they own.

In response, the Adani Group released a 413-page document saying Hindenburg, not Adani, was trying to manipulate the market to profit from their short positions.

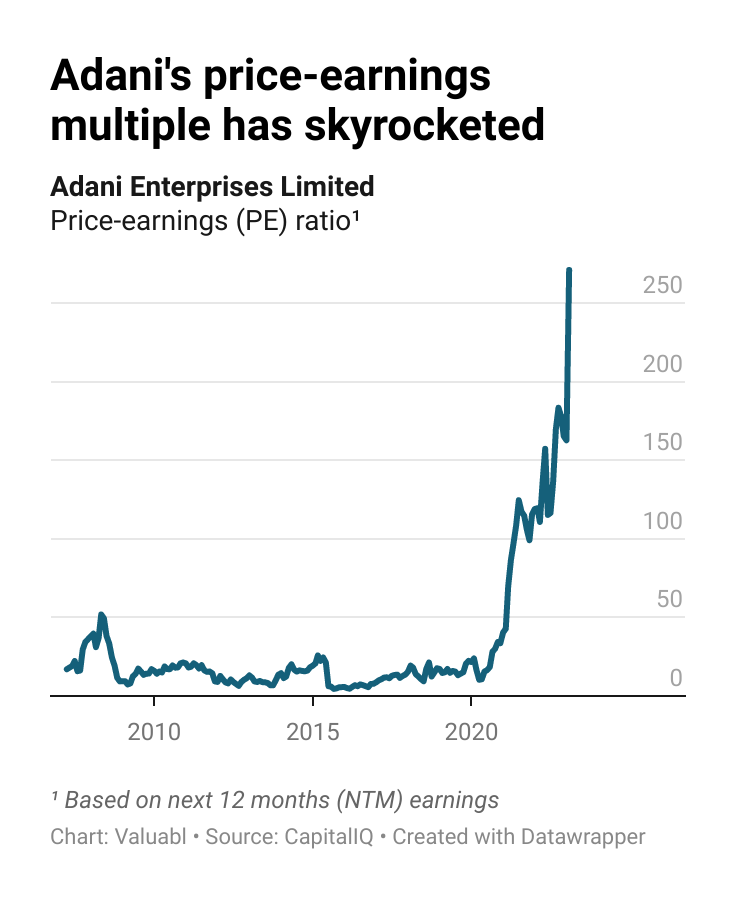

Whichever way you slice it, investors have overvalued Adani companies. The major public holding company within the group, Adani Enterprises, has a normalised price-earnings (PE) ratio of almost 300—meaning if bosses paid out all the company's usual annual profits to investors, it would take three centuries for them to recoup their investment.

This outrageous PE ratio follows a meteoric 1,600% rise in the stock price since 2020 and puts them in the top ten of the 543 emerging market trading companies I compared to Adani. Moreover, the firm's price-to-book ratio, a measure dividing the firm's market capitalisation by the balance sheet value of equity invested, is 10, putting it in the top 5% of peers.

Because you’re worth it?

Adani is a terrible business. Growth is sluggish, and profit margins have been gaunt for the past couple of decades. Since 2008, returns on capital have been lower than Indian government bond yields—the company is destroying economic value hand over fist. How, then, can investors justify paying such a high multiple? Likely, they can't. And if Hindenburg is correct, and Gautam has pulled off "the largest con in corporate history," investors who sucked the helium on the way up will be burning with it on the way down.

Cost of capital

Finance’s most important yet misunderstood price is capital. Here’s what happened to the cost of money in the past fortnight.

•••

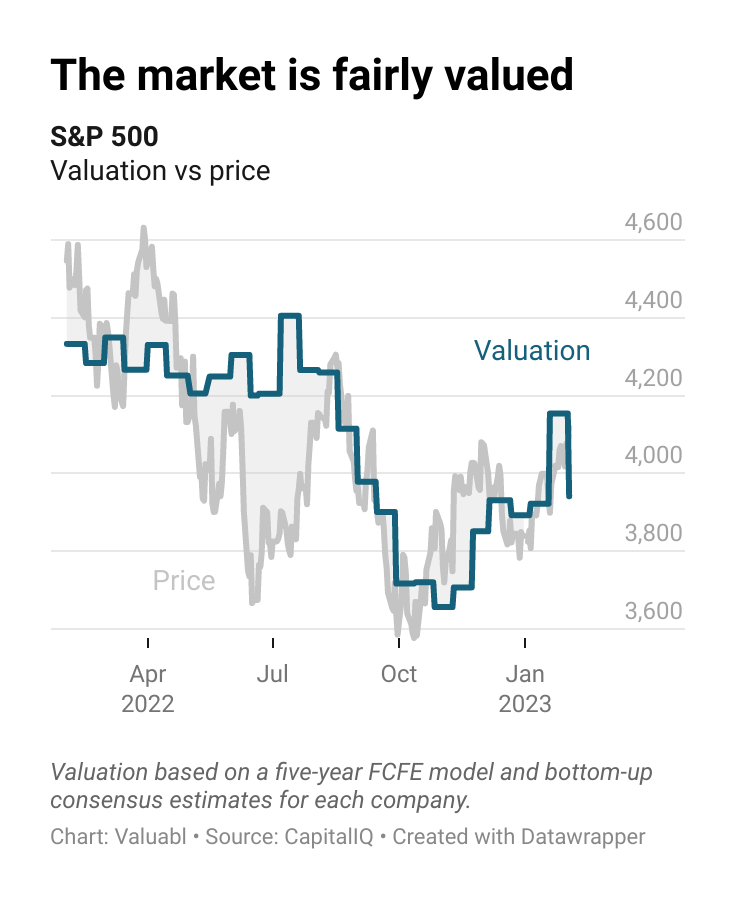

Stock prices rose last fortnight. The S&P 500, an index of big American companies, climbed another 4% to 4,077 despite inflation-adjusted interest rates increasing. The market continues to rise from its October lows but is still 10% below where it was last year. I value the S&P 500 at 3,941, which suggests it is slightly overvalued.

The companies in the index earned $1,741bn after tax in the past year. They paid out $446bn in dividends, bought back $924bn worth of shares, and issued $70bn of equity.

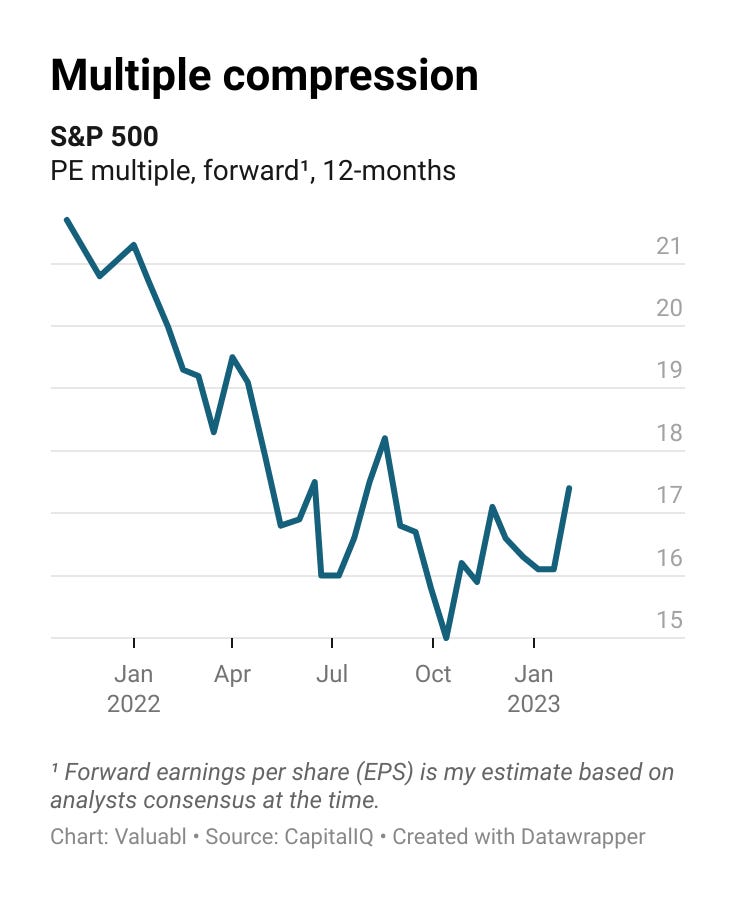

The forward price-earnings (PE) multiple jumped from 16 to 17 as my 12-month forward earnings per share (EPS) estimate for the index dropped from 243 to 237.

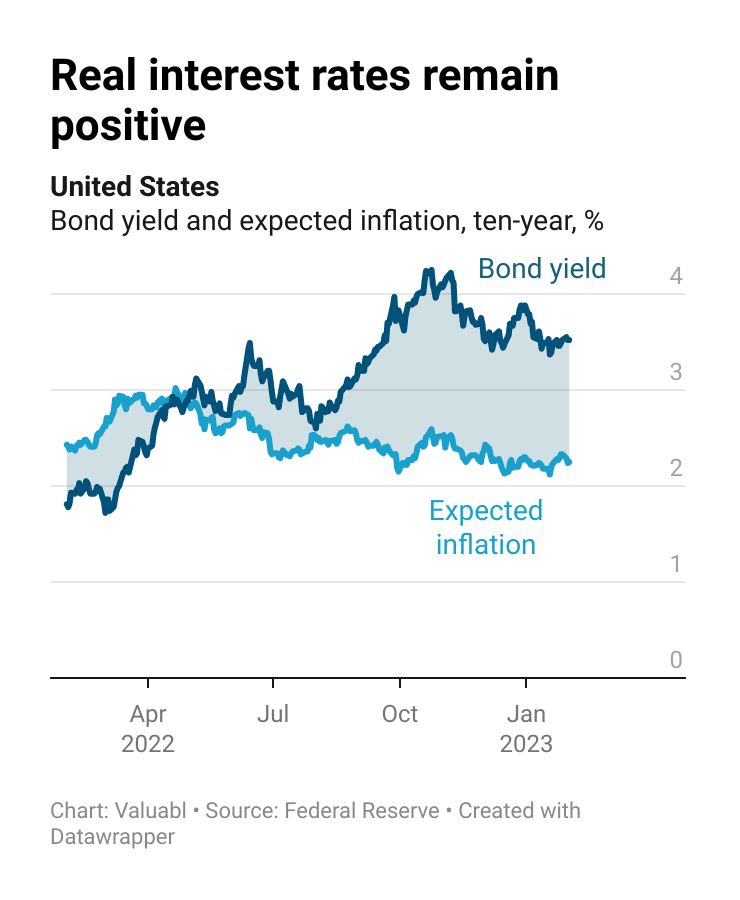

Government bond prices dropped. Yields, which move the opposite way to prices, rose as inflation expectations did. The yield on a ten-year US Treasury bond, a critical variable analysts use to value financial assets, climbed 15 basis points (bp) to 3.5%. Investors expect inflation to average 2.3% over the next decade, up 13bp from the rate they expected last fortnight.

Hence, the real interest rate, the difference between yields and expected inflation, increased by 2bp to 1.3%. These inflation-adjusted rates are up almost two percentage points in the past year.

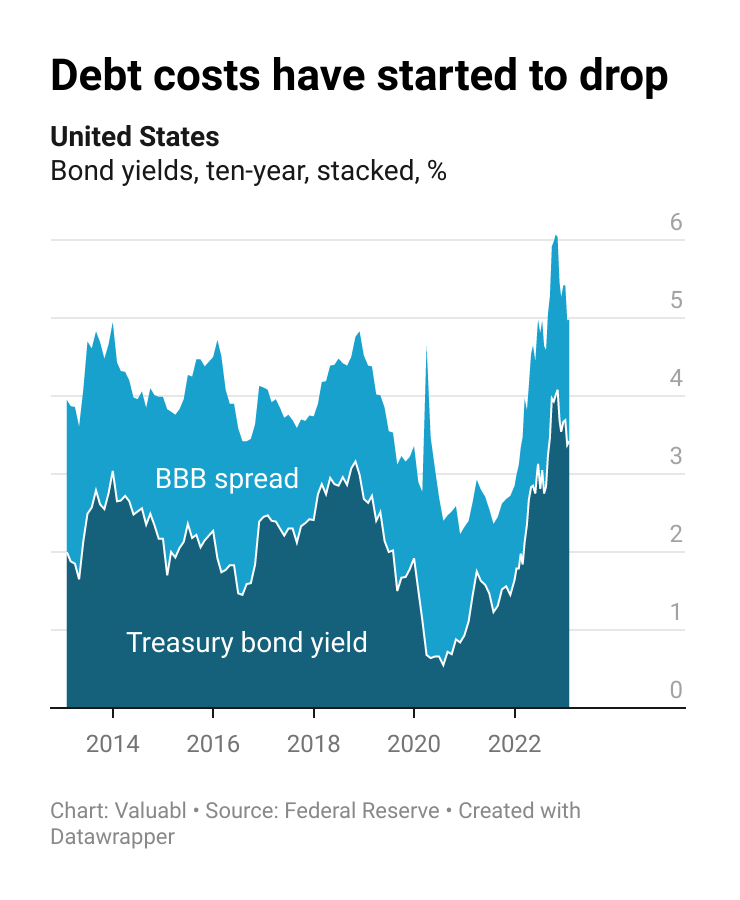

Corporate bond prices also went down. Credit spreads, the extra return creditors demand to lend to businesses instead of the government, fell by 4bp to 1.6%. The cost of debt, the annual return lenders expect when lending to these companies, jumped 11bp to 5.1%. Refinancing costs have effectively doubled, up 1.9 percentage points, in the past year. But they’ve been declining since they peaked in October above 6%.

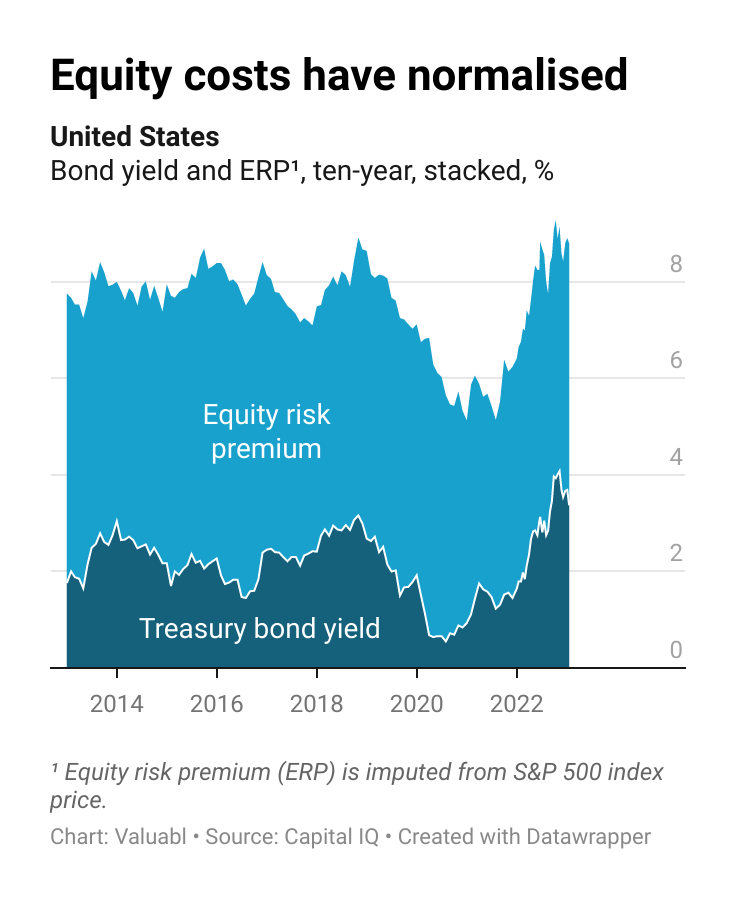

The equity risk premium (ERP), the extra return investors demand to buy stocks instead of risk-free bonds, tumbled 51bp to 4.9%. It’s now about the same as it was a year ago. Consequently, the cost of equity, the total annual return these investors expect, fell 36bp to 8.4%. These expected returns are also still roughly in line with the long-term average.

Global stocktake

Valuing regional and global stock markets to help us find the best ponds in which to fish for value.

•••

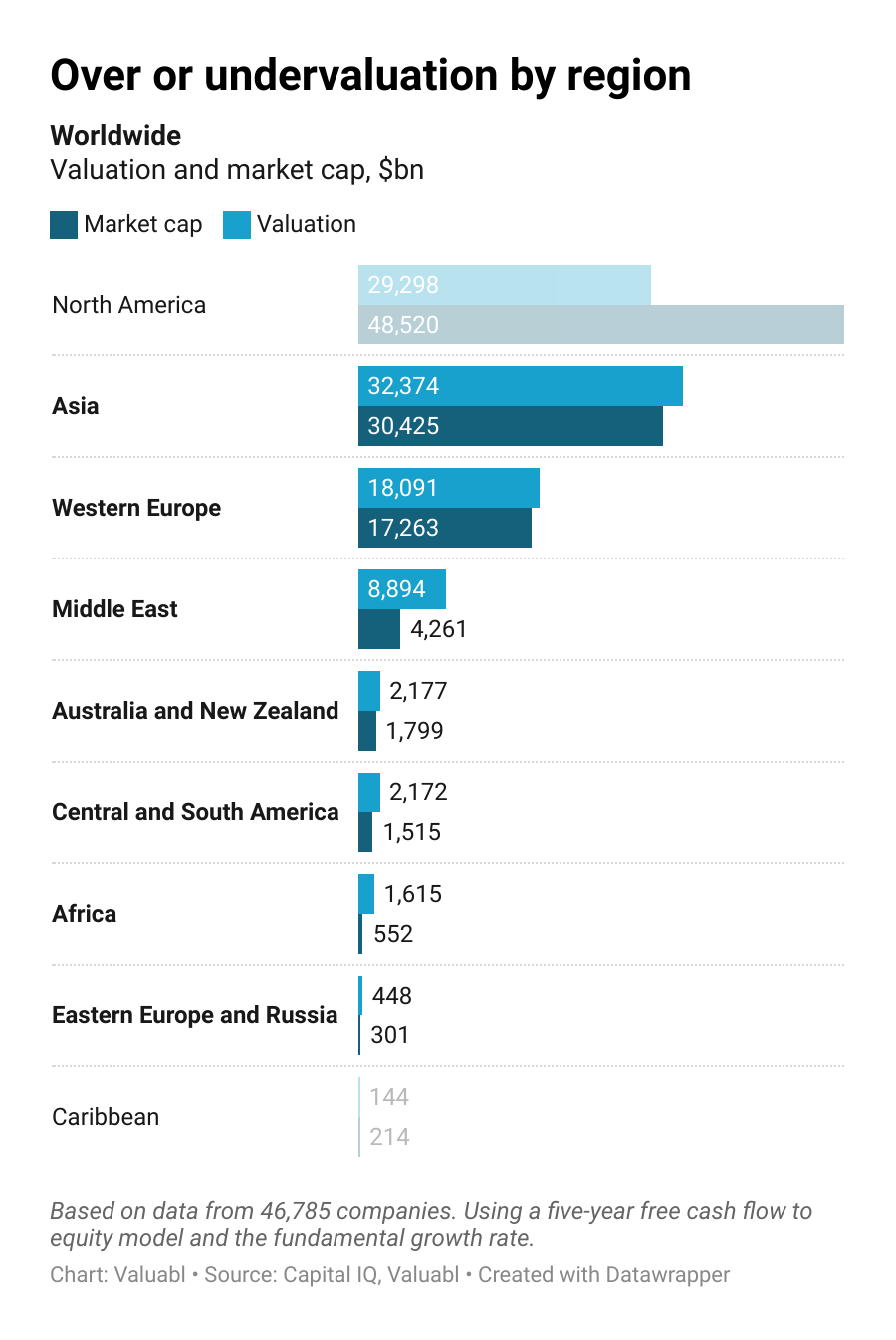

I used a five-year free cash flow to equity (FCFE) model and the fundamental growth rate, the growth in earnings predicted by the return on equity and retention ratios, to value stocks at $95.2trn globally. But given the $105trn price tag, global share markets, on average, still look slightly overvalued.

Valuations by region

African and Middle Eastern stocks look like the best value, while North American and Caribbean stocks are overvalued.

Valuations by sector

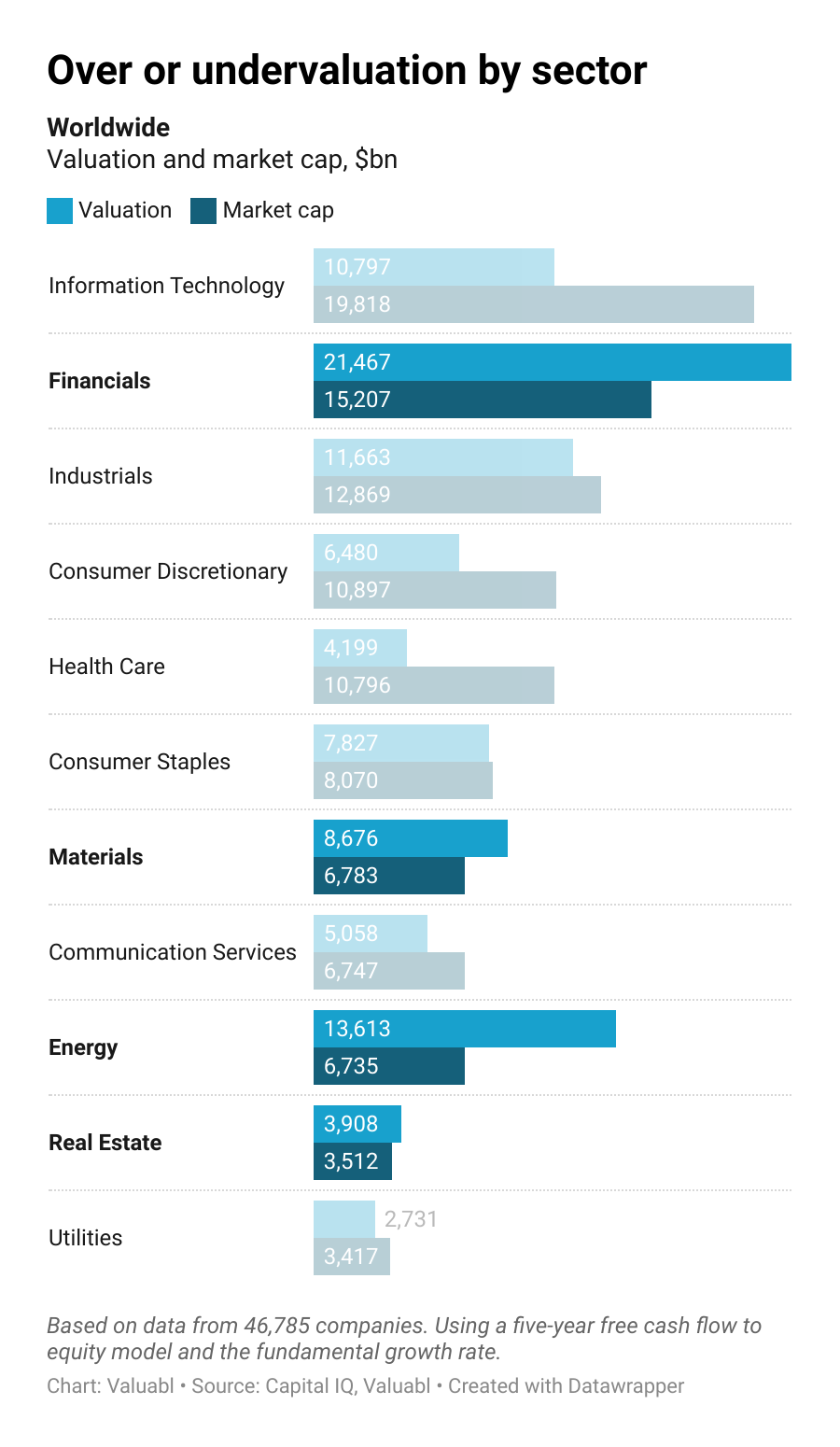

Energy, Financials, and Materials companies look the most undervalued. While Consumer Discretionary, Information Technology, and Health Care firms look the most overvalued.

Country and regional risks

The global equity risk premium, the extra return investors demand to buy global shares instead of bonds, dropped by 50bp to 6.4%.

Moody’s, a rating agency, downgraded Nigeria’s credit rating from B3 to Caa1, saying they expect the country’s fiscal position to continue deteriorating. They also downgraded Tunisia from Caa1 to Caa2 as they reckon the government will likely default. In contrast, they upgraded Uzbekistan from B1 to Ba3, saying the country’s reform program is going well and will continue.

Regional and sectoral data

Public companies have $44trn of common equity invested in them, and that equity earned a 13% after-tax return in the past year. Middle Eastern, African, and South American companies generated the most profit per dollar of shareholder funds. But Caribbean and Asian companies are still lousy.

Based on reinvestment, Middle Eastern, Eastern European, and African firms are likely to grow the fastest, while North American and Caribbean ones the slowest. North American firms are only reinvesting one in every four dollars of profit, while Caribbean companies earn a crummy 7% return on equity.

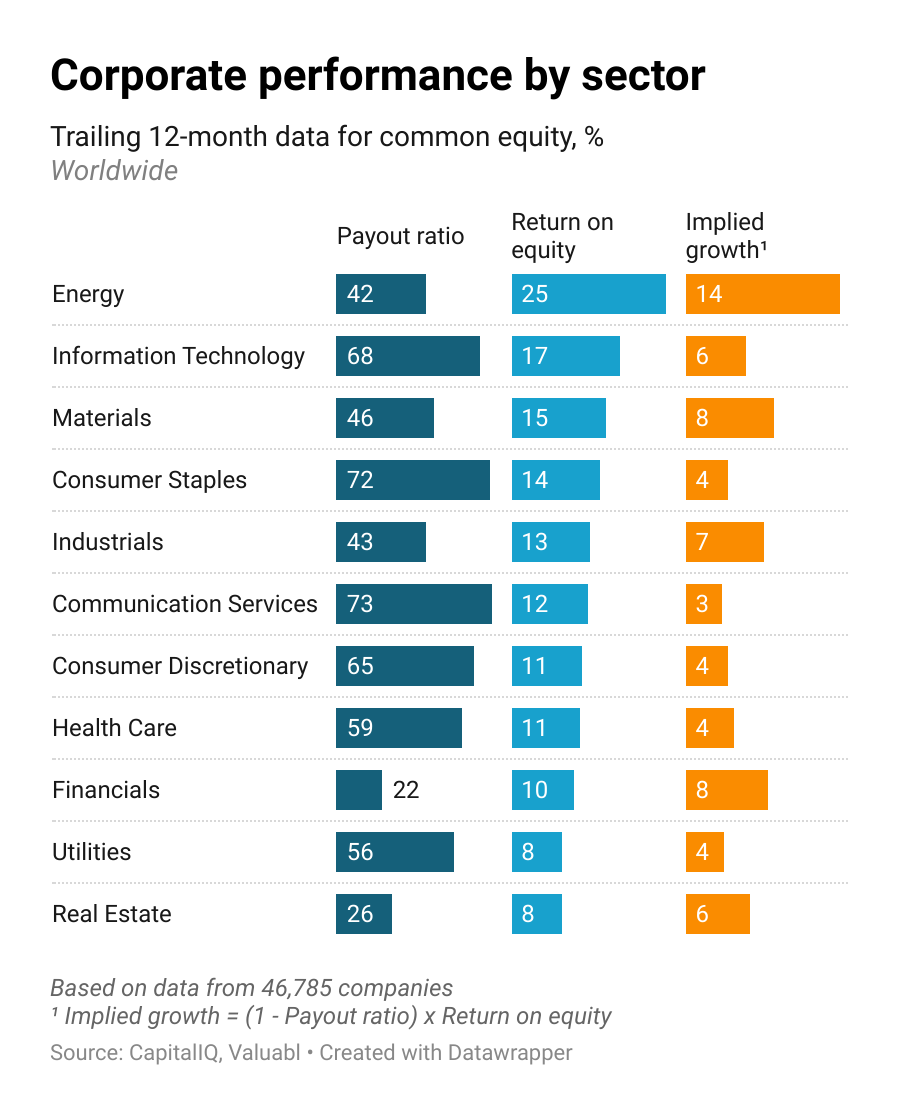

Based on growth rates suggested by the money companies have retained and what they earn on that capital, energy businesses are likely to expand the fastest. Their implied fundamental growth rate is 14%.

While this measure isn’t perfect—and given that inflation was pushed up by energy, material, and industrial prices—if these companies expand production, this will help reduce input prices for other companies and continue to pull inflation down. This disinflation has already started to feed into lower producer prices. The producer price index (PPI) dropped 0.5% in December.

Rank and file

Screening and valuing the cheapest stocks in undervalued regions and sectors.

•••

Screening criteria

Regions: Africa, Middle East, Asia, Australia and New Zealand, and Europe

Sectors: Energy, Financials, and Materials

Market cap: >$750m

Model: Five-year free cash flow to equity (FCFE) model using analysts’ consensus estimates for growth and margins.

Credit creation, cause and effect

The Federal Reserve buys and sells securities and sets interest rates to influence: borrowing costs, lending activity, price stability, and productivity, with varying effects.

•••

The Federal Reserve buys and sells securities

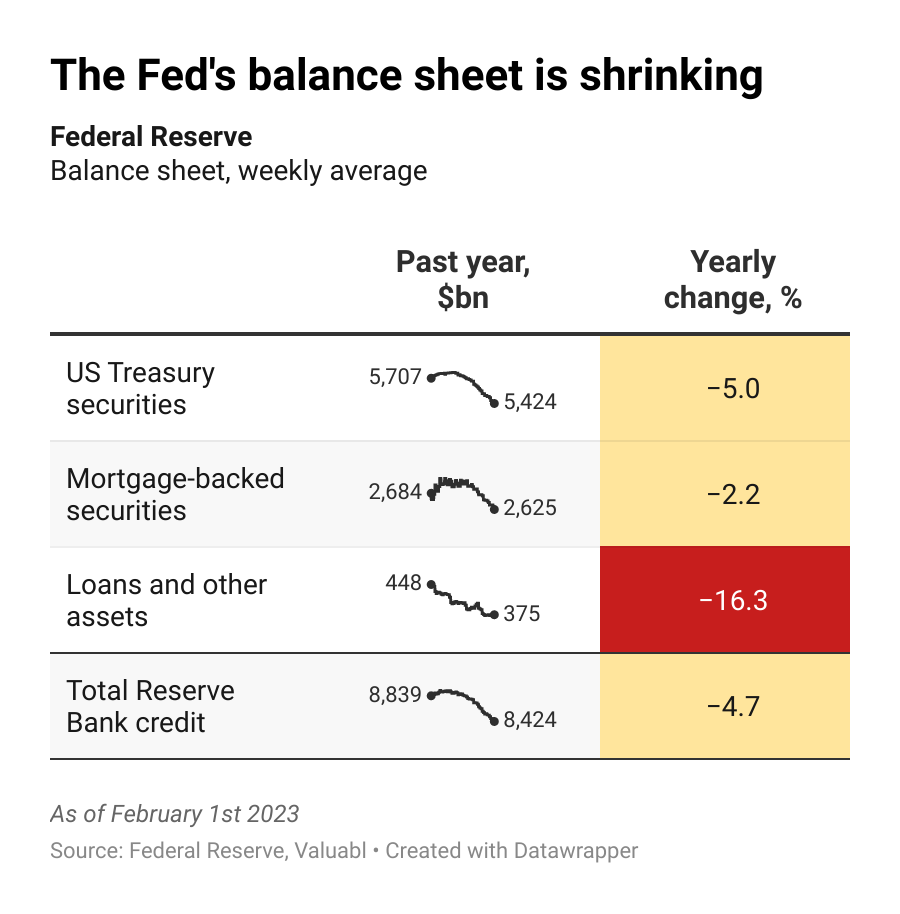

The balance sheet keeps shrinking

Last fortnight, the Fed trimmed $26bn from its Treasury security position and $16bn of mortgage-backed securities (MBS). The total amount of Reserve Bank credit shrank by $44bn. The Fed’s balance sheet reduction plan is in full swing, and the MBS position is down, year-on-year, for the first time since 2020.

And sets interest rates

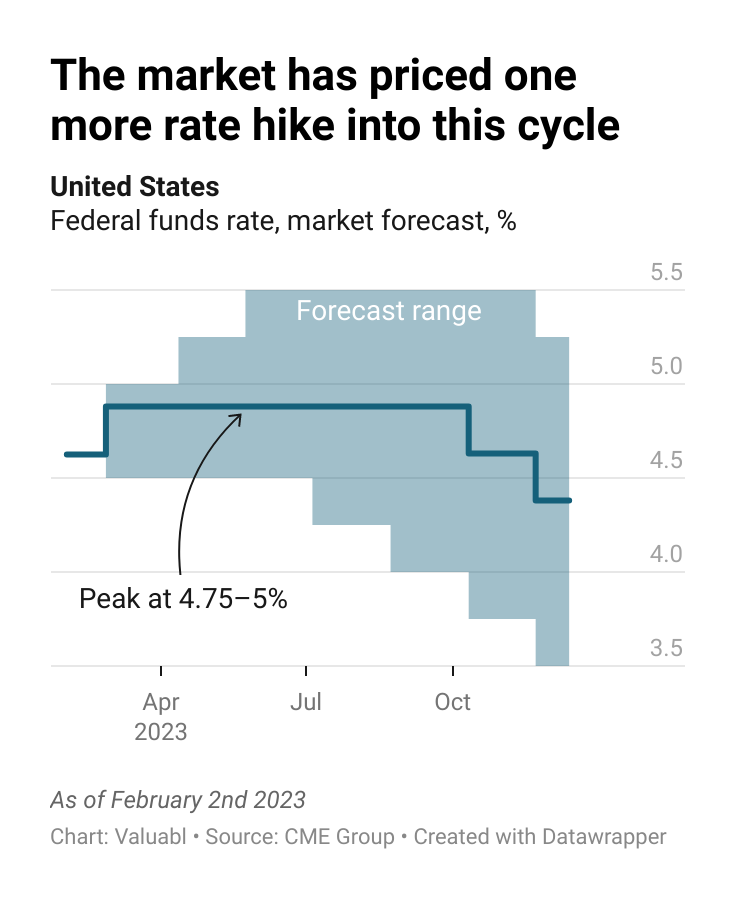

The market has priced one more rate hike into this cycle

The federal funds rate, the interest banks charge to lend reserves to each other, is currently between 4.5% and 4.75%. Interest rate traders reckon the Federal Open Market Committee (FOMC), the people who decide the interest rate, will push rates up once more to a peak of 4.75-5%. Those traders have priced in a 25bp hike at the March meeting but also reckon the Fed will start to cut rates in November as the American economy falls into recession.

To influence: borrowing costs

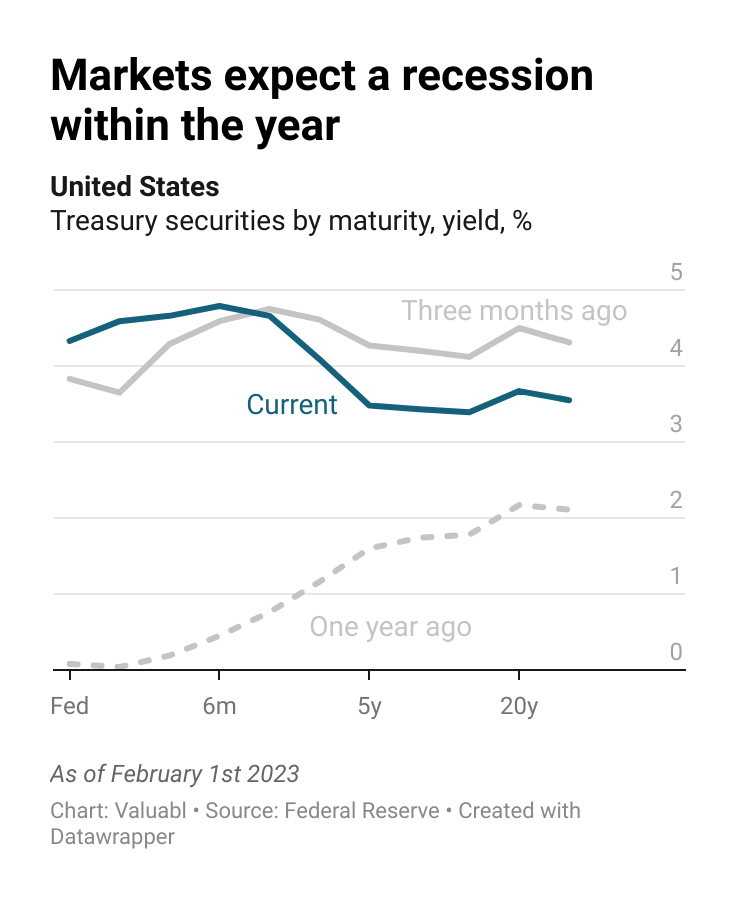

Markets expect a recession to start this year

The yield curve is still inverted from six months outward. Bond traders reckon a recession is coming, and the Fed will start to cut rates in less than a year. The long end of the curve, which previously hovered around 4% from five-year bonds onward, has dropped well below the level it was at three months ago. But yields are still much higher than they were last year.

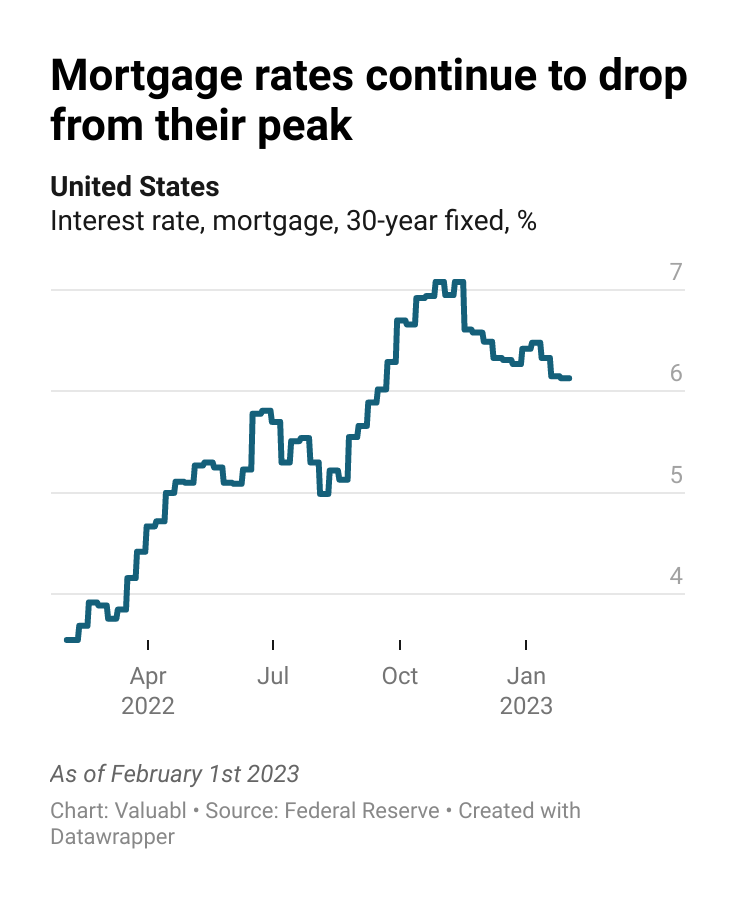

Mortgage rates are dropping with bond yields

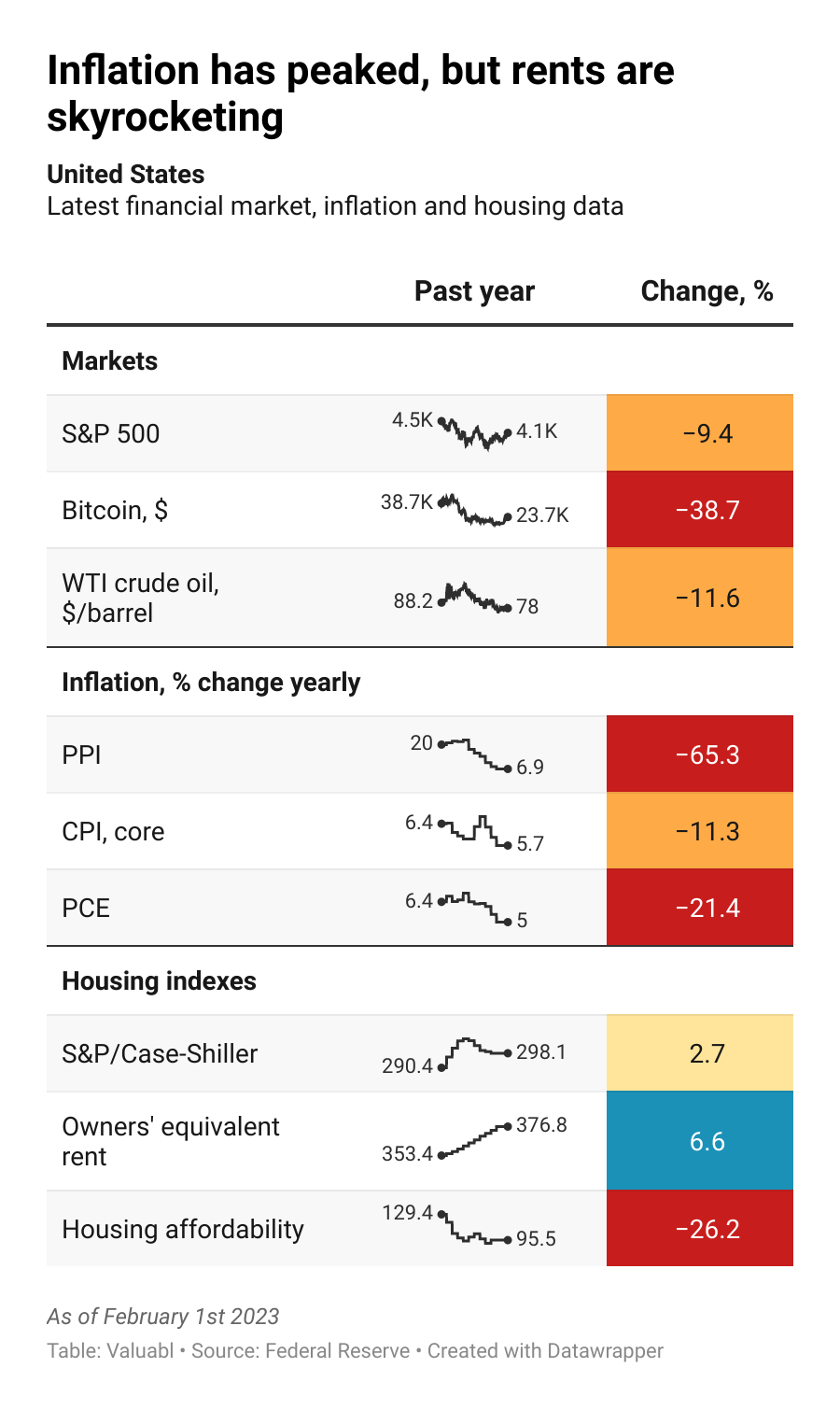

American homebuyers will pay some of the highest interest rates in years for new mortgages. A 30-year fixed-rate mortgage costs 6.1%, up dramatically from the 3.5% rate a year ago. As a result, the Fed’s housing affordability index has fallen by a third in the past year. Prospective homeowners cannot afford to buy, which has put downward pressure on prices. But mortgage rates have started to drop with bond yields.

Lending activity

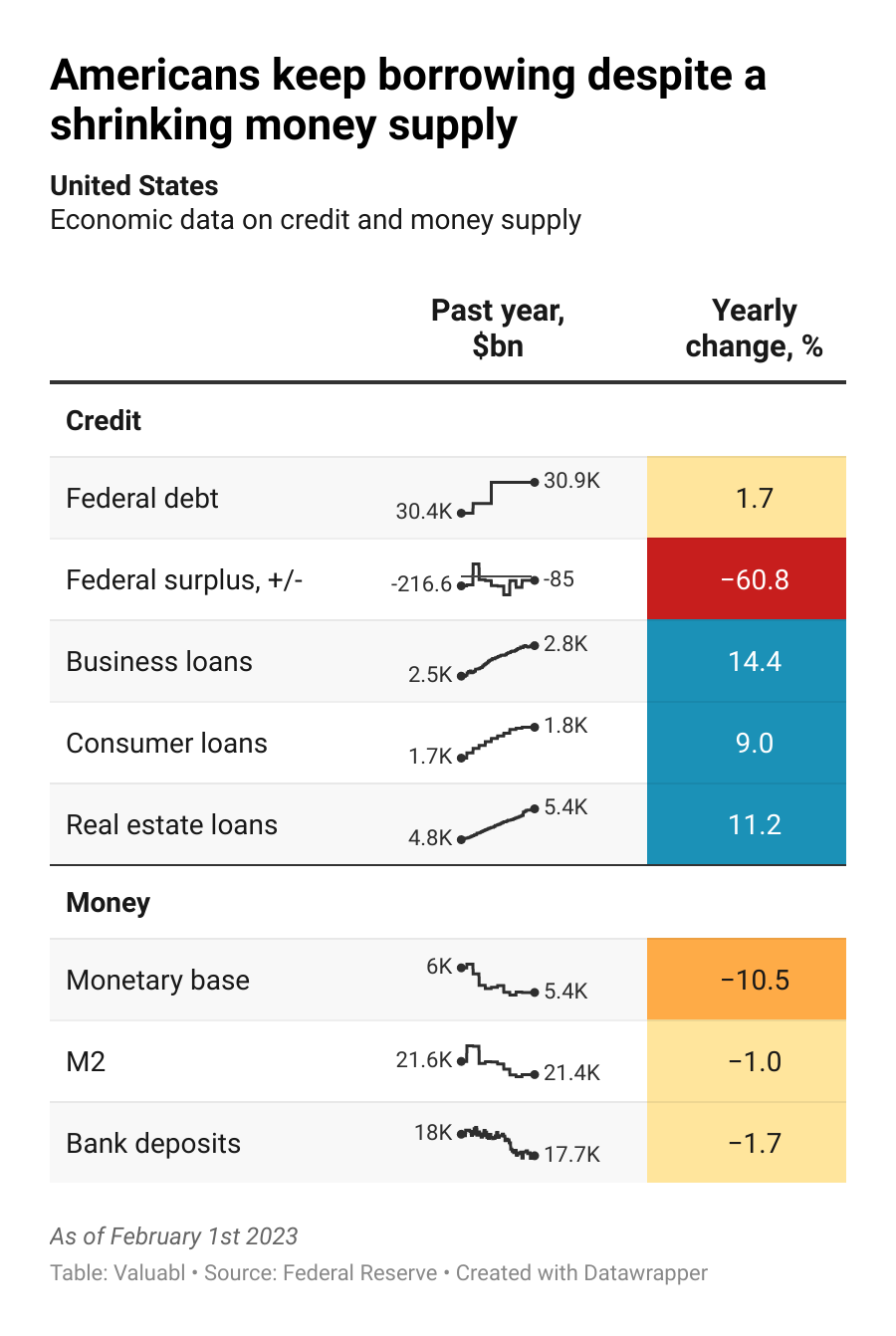

Americans have borrowed more and more

It continues to seem like nothing can stop Americans’ thirst for debt. Shoppers, bosses, and landlords have borrowed expeditiously despite higher rates, but consumer lending has started to level off.

For the first time on record, M2, a measure of the amount of money out there, has dropped. As bank lending slows, bank deposit growth will drop and reduce the amount of spendable money. That has started to happen. Commercial banks’ deposits have rolled over and now trend down. There is less money in the economy but higher levels of debt—a signal that credit stress is likely to start building soon.

Price stability

Inflation has peaked, but rents continue to rise

Inflation is on its way down. The rate of increase in commodity prices has declined substantially. Other measures of inflation have peaked and now trend down. The market’s inflation forecast for the next ten years has also dropped—a vote of confidence in the Federal Reserve’s ability to control inflation.

It depends on what happens to profit margins and wages, but lower commodity price inflation will likely feed through to slower rises in the consumer price index (CPI) over the next few quarters. But there is still a way to go. The personal consumption expenditures (PCE) price index, an estimate of household goods prices, has dropped from a 6.4% yearly growth rate to a 5% one.

But rents, which lag other inflation indicators, are skyrocketing. They’re up 7% in the past year despite a meagre 4% wage bump. As interest rates go up, landlords raise rents to cover the higher costs, exacerbating inflation and putting more pressure on the Fed to hike rates. As a result, household spending on shelter is climbing, and a housing affordability crisis is unfolding. But households will reach a breaking point.

And productivity

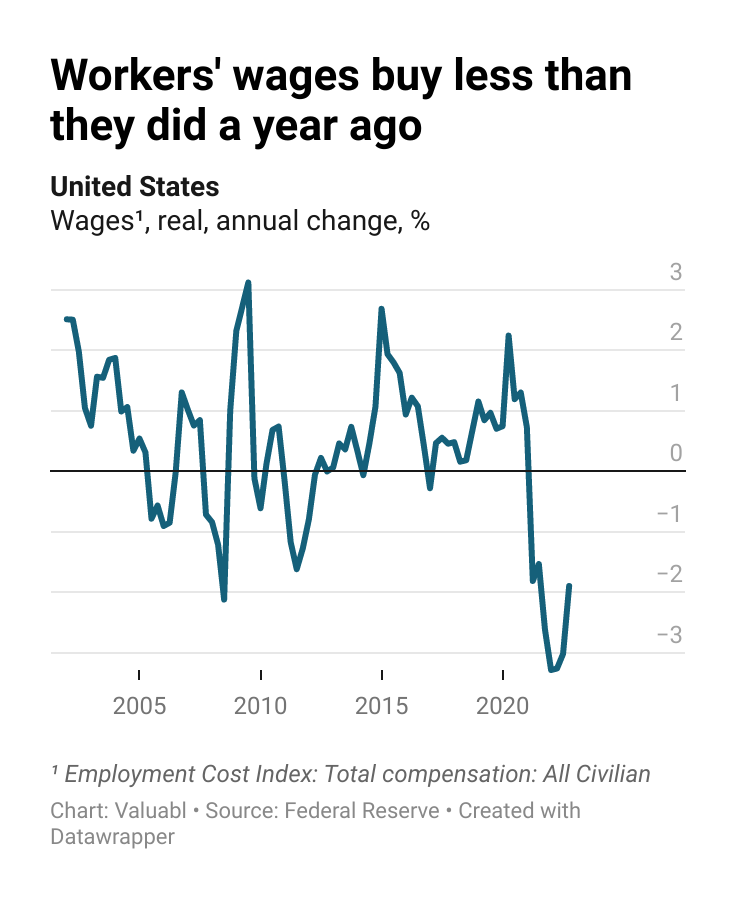

Meagre wage rises have hit households’ wallets

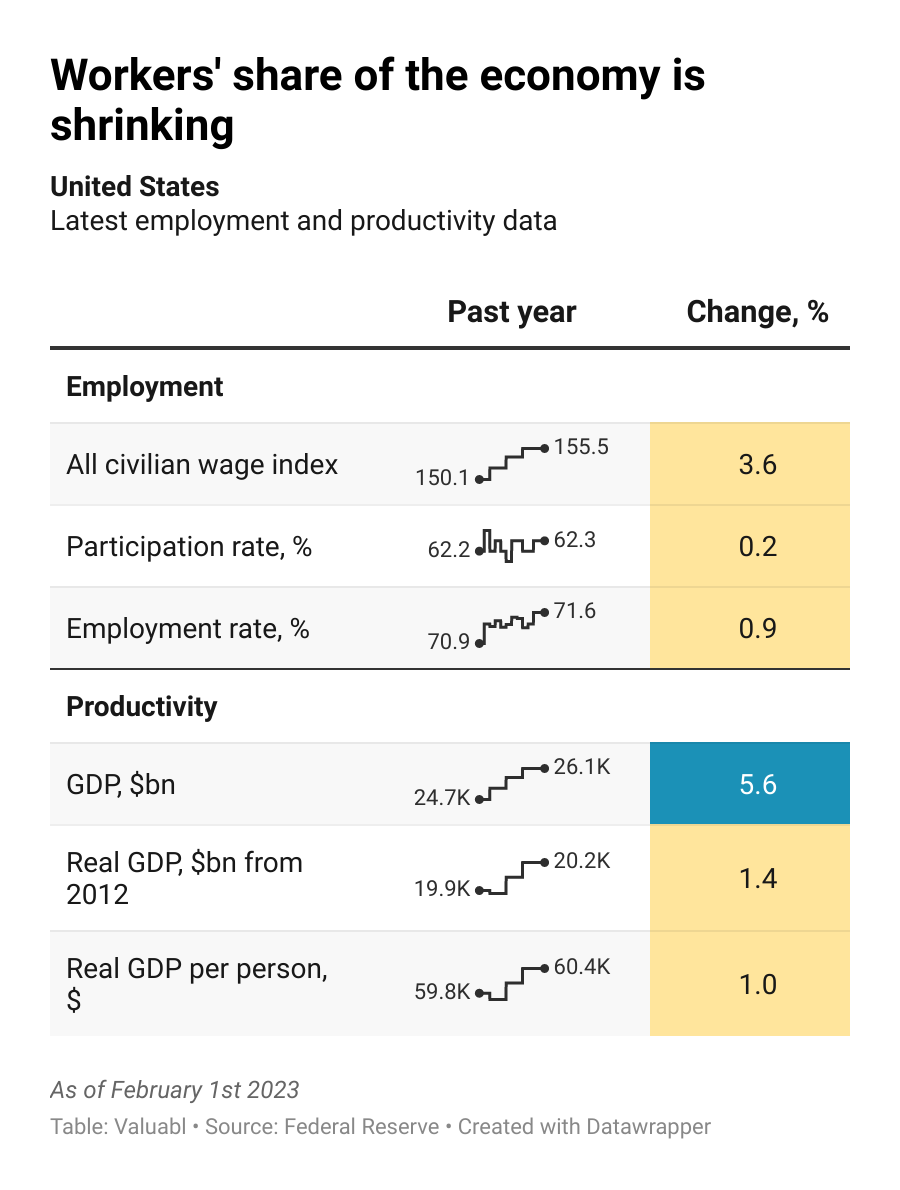

Workers still haven’t received adequate raises. The all-civilian wage index is up just 4% in the past year despite the 6% jump in consumer prices and a big jump in shelter costs.

The lack of wage pressure has helped prevent an inflationary spiral where salaries and prices rise concurrently in a feedback loop. But workers worldwide are irked and have started to strike, demanding significant pay increases—although it’s unlikely they’ll get them. Instead, some, frustrated by a rising cost of living and stagnant wages, will choose to leave the workforce. But overall employment levels remain strong.

With varying effects

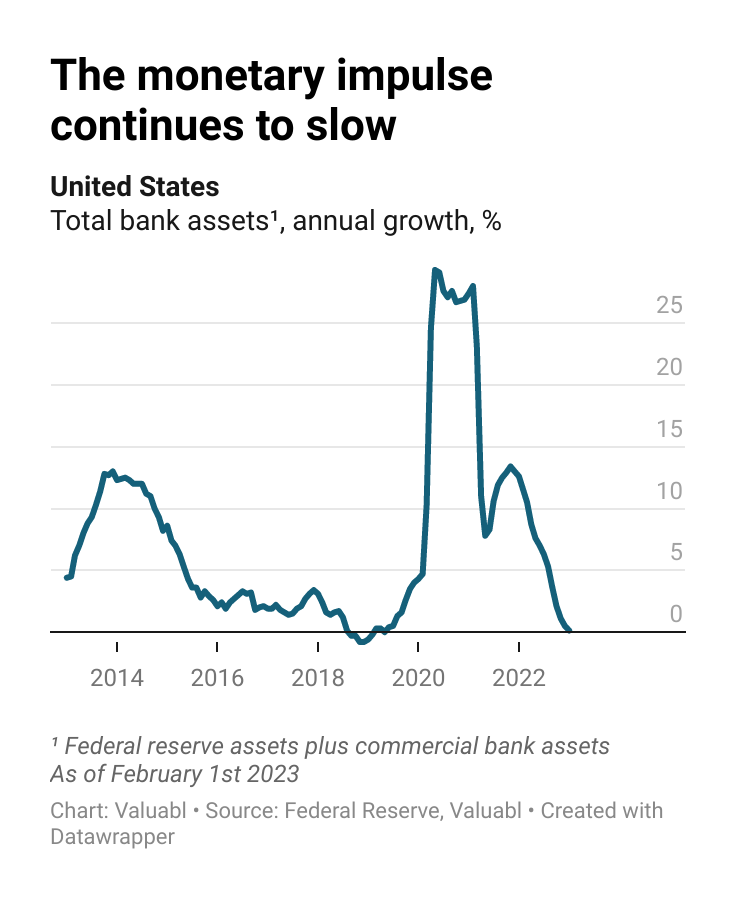

The banking sector is about to shrink, signalling a slowdown is imminent

The monetary impulse—my estimate of the change in the amount of money using total central and commercial bank assets—has slowed. While the rate of change is still barely positive, it has fallen quickly as central banks have vacuumed up money.

In the year to January 2023, the monetary impulse grew by 0.1%, the slowest expansion since before the pandemic. The February numbers are likely to show negative growth. If that happens, and consumer price inflation continues to drop, we are likely to see rate hikes stop and cuts come into play.

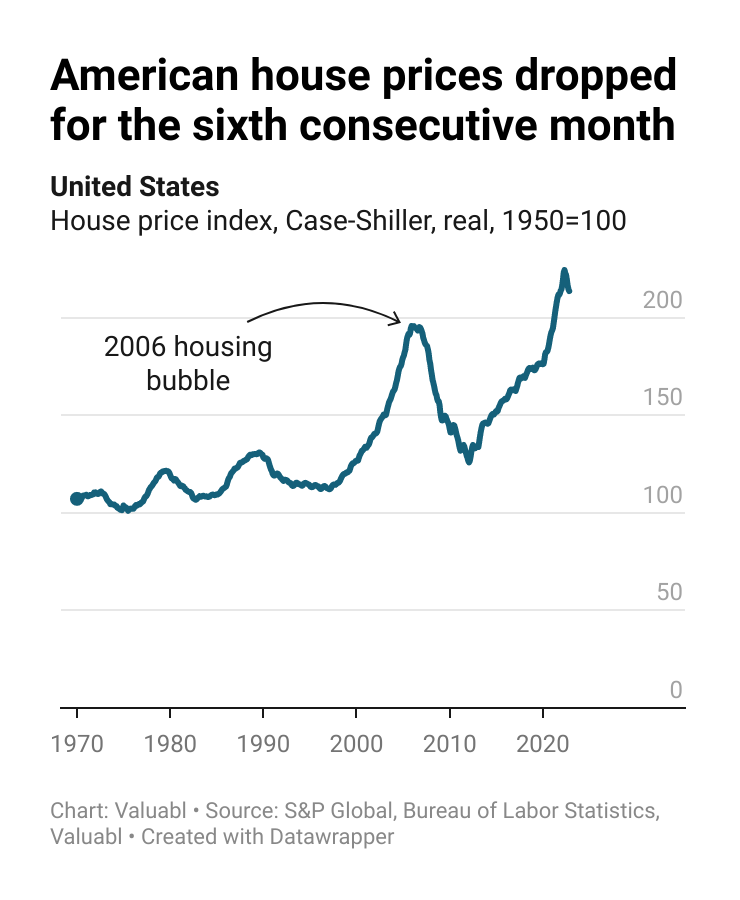

American house prices have fallen for six straight months

For the first time since 2006, when America’s housing bubble burst and kick-started the worst financial crisis of the modern era, house prices in the US have started to fall. In inflation-adjusted terms, they’ve lost 5% since their May 2022 peak, or a 10% annualised drop. That pace of decline is the fastest since the depths of the global financial crisis (GFC).

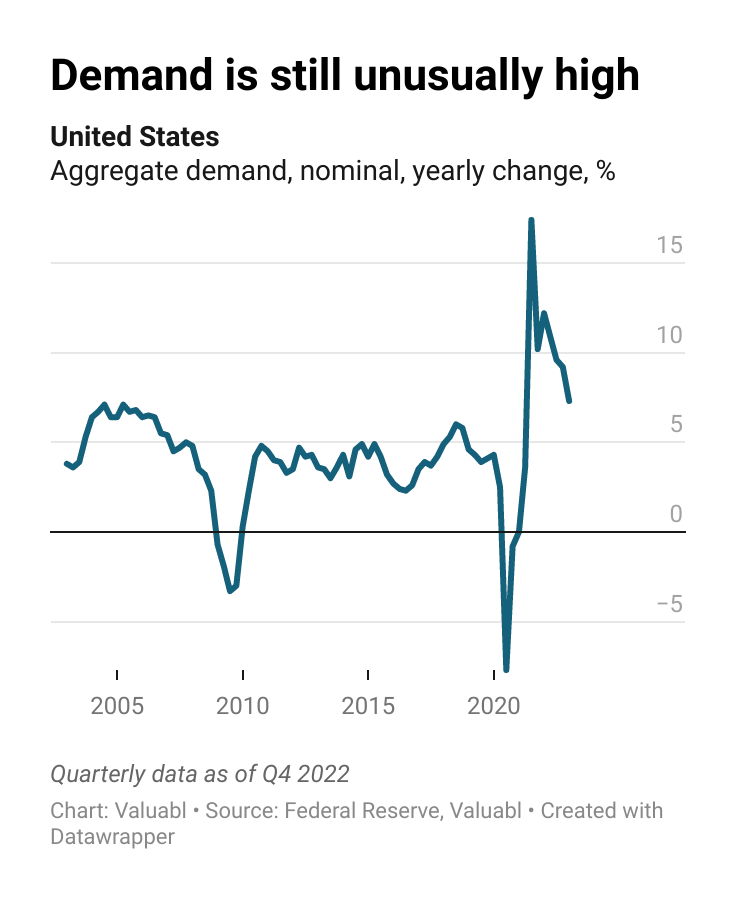

Total demand is still unusually high

Consumers shopped less when the pandemic hit and the world locked down. As a result, nominal aggregate demand, the total amount spent, dropped precipitously. But as our economies began to reopen, households with extra savings went nuts. Demand spiked, and although it has trended down towards the long-term 4% average growth rate, it is still unusually high. As of the fourth quarter of last year, nominal aggregate demand was still 7% higher than the year before. But as the monetary policy tightens, people will have less to spend, and demand will drop.

Debt cycle monitor

Private debts are a better economic crisis indicator than public debt. High and rapidly growing levels of private debt weigh on aggregate demand. Interest rate rises make debt maintenance more difficult and can kick off a deleveraging.

•••

Risk of private-debt crisis

High¹: France, Korea, Sweden, Switzerland, Thailand

Medium²: Australia, Belgium, Brazil, Canada, China, Ireland, Japan, Netherlands, Spain, United Kingdom, United States

Low³: Germany, India, Indonesia, Italy, Mexico, Poland, Russia, Saudi Arabia, Turkey

¹ High-risk: Country has a private debt ratio > 150%, five-year growth in private debt > 10 percentage points, and interest rates going up.

² Medium-risk: Two of the three criteria above.

³ Low-risk: One or less of the three criteria above.

Investment idea

To help readers buy low and sell high, this is the best investment idea I found in the past fortnight.

•••