Vol. 3, No. 12 — Semiconclusterf***ed

Growth at an unreasonable price; Sinking energy prices will drag down inflation; The S&P 500 looks frothy; The French are staring down the debt-crisis barrel; Value in cornstarch and sweeteners

Welcome to Valuabl, a twice-monthly newsletter providing financial analysis with a value-oriented perspective. Here to help bankers and fund managers make smarter investment decisions. Learn more

In this issue

Quotation from Warren E. Buffett

Job board

Cartoon: Safe for now

Semiconclusterf***ed

Cost of capital

Monetary mechanics

Global stocktake

Rank and file

Debt cycle monitor

Investment idea

Read time: 27 minutes

Quotation

“The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage.”

— Warren E. Buffett

Job board

Greenwich Partners, a global hedge fund, want an equity analyst in London.

Goldman Sachs, an investment bank, want a quantitative analyst in New York.

Looking for high-quality people? Thousands of bankers, analysts, and investors read Valuabl every fortnight. Email valuabl@substack.com to post your role here for free.

Cartoon: Safe for now

Semiconclusterf***ed

Growth at an unreasonable price

•••

Shares in NVIDIA, a computer chip maker, have boomed. They're up 170% this year and have crushed almost every other stock. Investors think artificial intelligence (AI) will change the world and want a slice. They reckon NVIDIA will make the hardware that powers AI, and they've bid hand-over-fist to get in. However, some punters wonder whether the rally is overdone. Has the price risen too high? The answer is yes. Investors have overvalued the company and will get lacklustre returns from here.

First, despite ambitious growth and profitability expectations, the shares are expensive. Fifty analysts cover NVIDIA and expect the top line to grow five-fold in ten years. They also think margins will expand to 55% from their already-juicy 35% level. If they're right, NVIDIA would be the world's fastest-growing billion-dollar-plus public semiconductor company. It would also have the widest profit margins. It's plain to see that analysts are confident about the firm's future.

Using those assumptions, a discounted cash flow model suggests each share is worth $110-130. That is far below the $390 level the shares trade at, meaning they could drop by 70%. Even if this already rosy vision for the future turns out to be conservative, the shares are still overvalued.

Second, equity investors have baked a 5-6% annual return into the current price. That is far too low to compensate them for the risks they face. The yearly expected return is so small it's about half the 11% minimum return investors should demand of a company like NVIDIA. Since NVIDIA's cash flows are riskier than the market, equity investors should expect a higher return. By way of comparison, they can get almost 9% by buying the S&P 500 at current prices.

Moreover, imagine you bought ten-year US government bonds. In that case, you would get almost 4% per year. The semiconductor business is cyclical, discretionary, and has high fixed costs. Given these risks, an extra two percentage points per year above the risk-free rate is insufficient.

Third, the shares have a price-to-sales (PS) ratio comparable to dotcom tech stocks. In 2000, speculative tech IPOs traded at about 40x sales. But those companies were small and had quick-growing sales. NVIDIA doesn't fit this profile as it's a big company that already has $26bn in sales.

Moreover, NVIDIA's ratio is the highest of its peers and 17 times higher than the median semiconductor company. If the company paid all its profits as dividends, it would take three lifetimes to get your money back. But it would only take 18 years for the average semiconductor stock.

Yet, artificial intelligence, and the industries that serve it, have huge potential. The history of technology is littered with the bodies of naysayers and sceptics. However, it is unclear how big the market will get or who the winners will be. While some bold predictors will be correct, most will be wrong. Fewer still will get adequate compensation for the risk they take. But that doesn't even matter in this case. Even if you assume NVIDIA takes over, investors will get poor returns at the current valuation.

Cost of capital

Finance’s most important yet misunderstood price is capital. Here’s what happened to the cost of money in the past fortnight.

•••

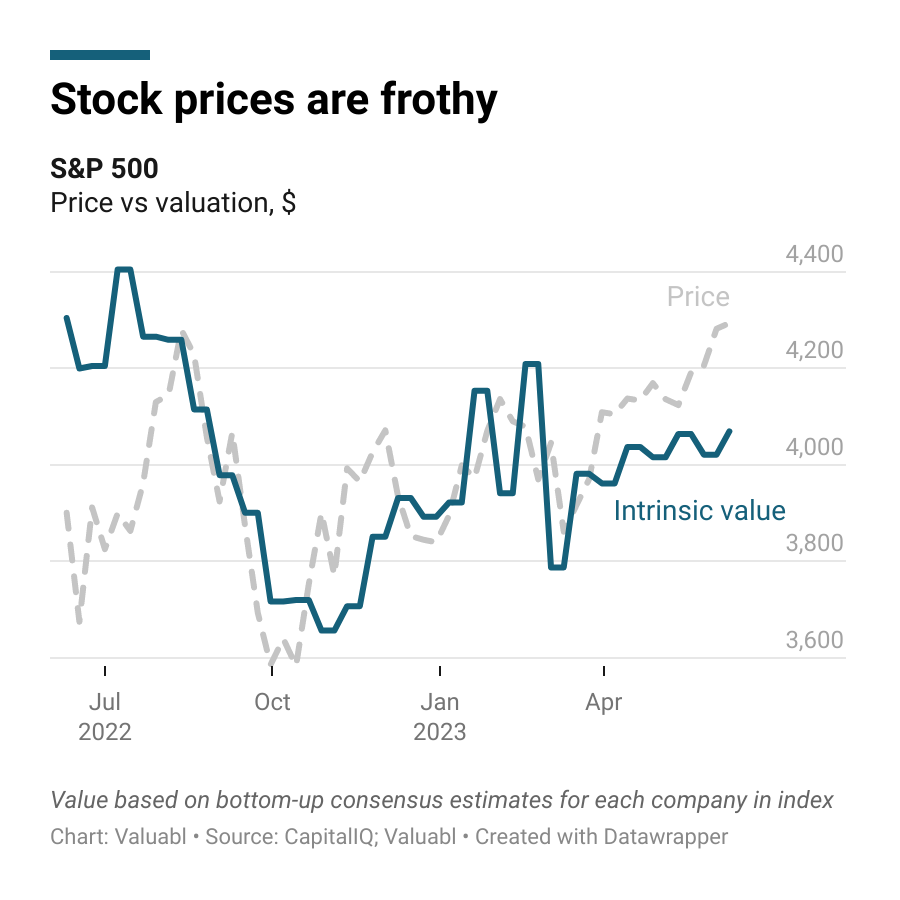

Stock prices rose last fortnight. The S&P 500, an index of big American companies, climbed 3% to 4,294. The market is now 4% higher than a year ago. Stock prices have been resilient in the face of rate hikes.

I value the index at 4,070, which suggests it is slightly overvalued. Excitement over the future of artificial intelligence has buoyed prices for tech companies. NVIDIA, a chipmaker, in particular, has done well lately. But the market is getting a little frothy.

The companies in the index earned $1,641bn in the past year. They paid out $517bn in dividends, bought back $923bn worth of shares, and issued $69bn of equity.

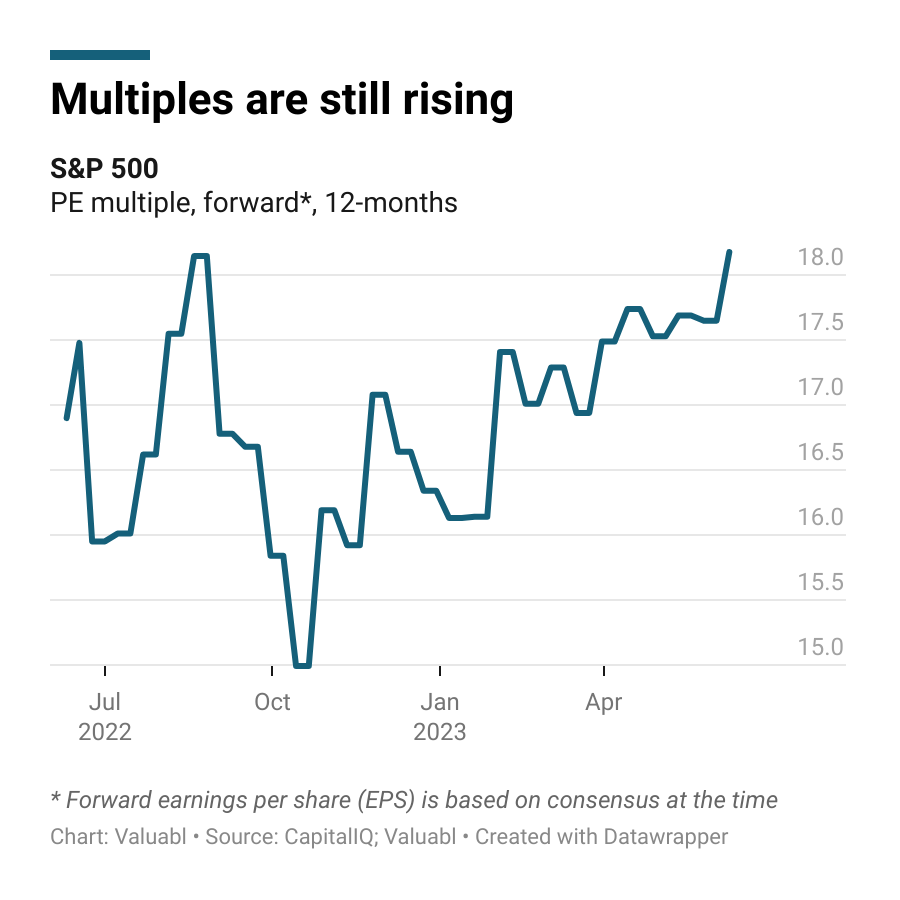

The forward price-earnings (PE) ratio jumped to 18.2x. My 12-month forward earnings per share (EPS) estimate for the index also climbed from $235.20 per share to $236.20.

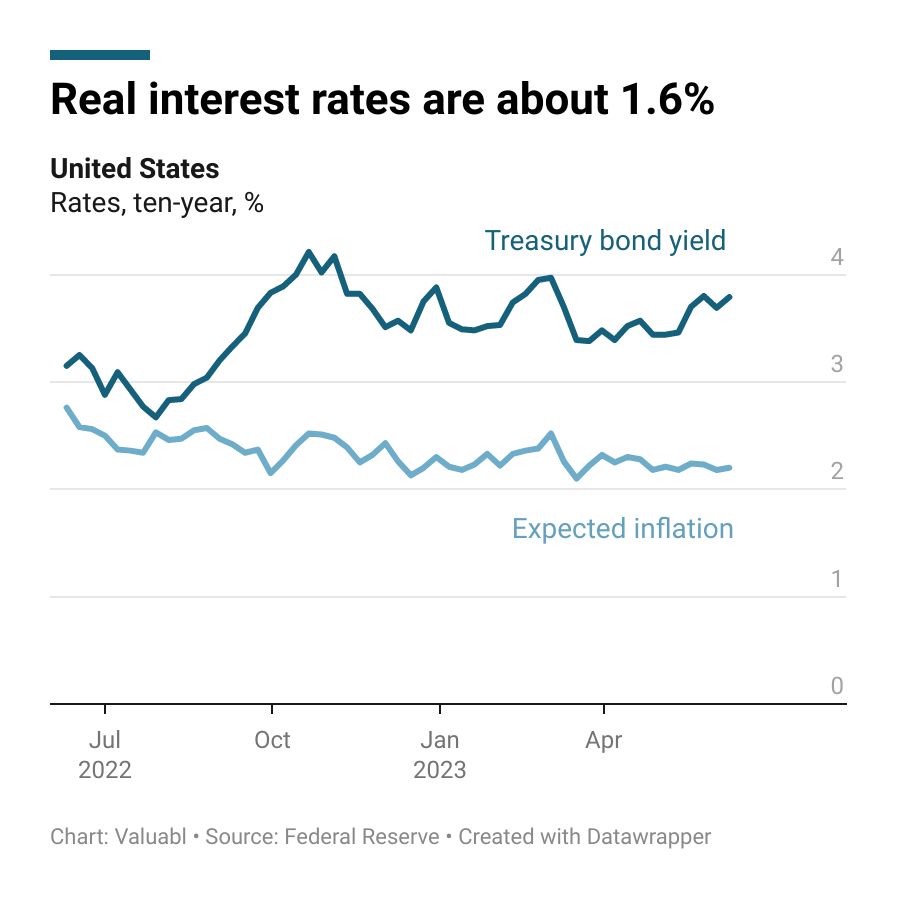

Government bond prices rose. The ten-year Treasury yield, which moves the opposite way to prices, fell 4 basis points (bp) to 3.8%. Investors expect inflation to average 2.2% over the next decade. Their inflation forecast has fallen 55bp in the past year.

The real interest rate, the gap between yields and expected inflation, rose a single basis point to 1.6%.

Corporate bond prices also rose. Credit spreads, the extra return creditors demand to lend to a company instead of the government, dropped 2bp to 1.7%. While the cost of debt, the annual return lenders expect when lending to these companies, fell 6bp to 5.5%.

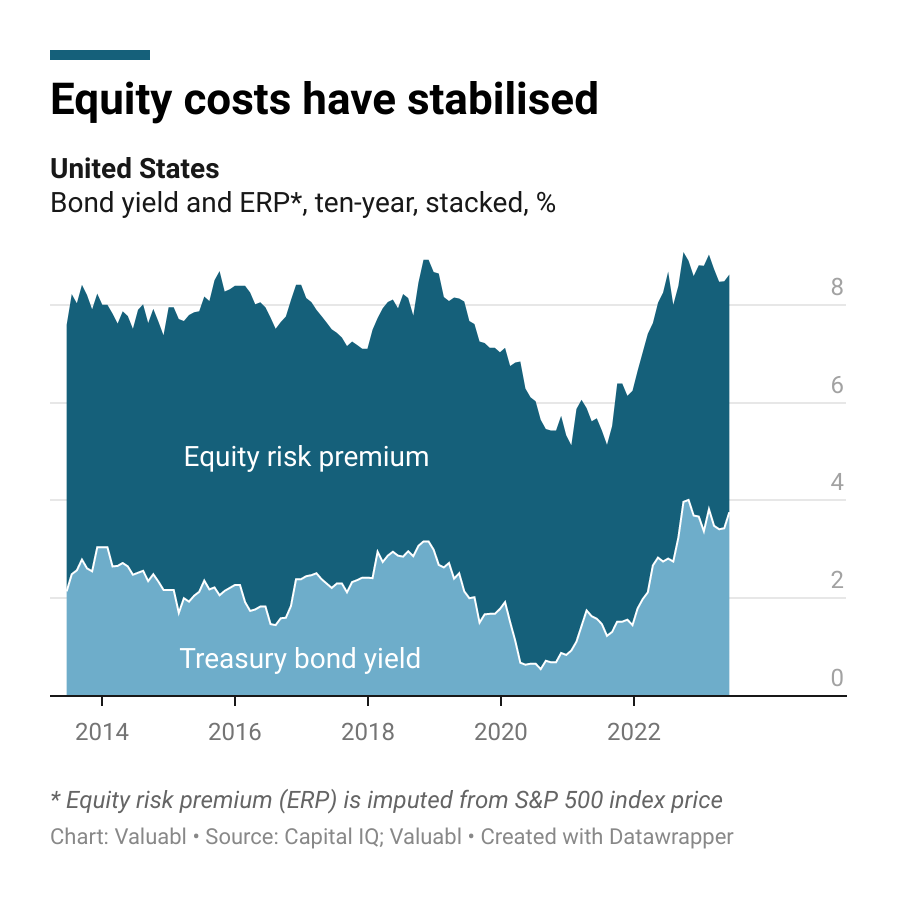

Government bond yields are still the driving force behind changes in the cost of capital.

The equity risk premium (ERP), the extra return investors want to buy stocks instead of bonds, fell 11bp to 4.9%. It’s now 64bp below where it was last year. The cost of equity, the total annual return these investors expect, dropped 15bp to 8.6%. These expected returns are in line with their long-term average and have stabilised.

Equity investors do not see a recession on the horizon.

Monetary mechanics

Sinking energy prices will drag down inflation

•••