Vol. 4, No. 11 — The two-speed economy

The rich are living it up while the poor struggle; GameStop speculators are crying foul, again; Investors have an irrational fear of stock dilution; An undervalued e-commerce platform with 40% upside

Contents

The world this fortnight

Leader | The two-speed economy

Letters to the editor

Opinion | No, the market isn’t rigged

Finance | Dilutaphobia

Cost of capital

Investment idea | An undervalued e-commerce firm

Economic and financial indicators

The world this fortnight

Computer chip maker, NVIDIA, crushed analysts’ consensus estimates in the first quarter. Sales hit $26bn, up 262% from last year. Jensen Huang, the firm’s founder and boss, highlighted a strong demand for artificial intelligence (AI) technologies from big data centres. He also pointed out that many governments, including Japan, France, and Singapore, have started building sovereign AIs. The company announced a ten-for-one stock split and a 150% dividend increase.

A mysterious tweet from Keith Gill’s X account reignited the meme-stock frenzy, causing GameStop shares to more than triple. However, investors lost $13bn over the next three days as the stock plummeted back to earth. Hedge funds shorting the stock also found themselves in trouble, reminiscent of their 2021 losses. The firm swiftly announced it plans to sell 45m shares to raise an extra $900m. But analysts don’t think this will stop the firm’s declining sales.

American retail behemoth Walmart reported that sales jumped 6% in the first quarter. All operating segments grew, and the company noted that its e-commerce and advertising businesses did the best. According to John David Rainey, the finance boss, the firm’s automation investments are paying off. Costs fell, and operating profits rose 13%. However, they decided to close all 51 US healthcare clinics because they couldn’t make them profitable.

In China, digital media firm Tencent also reported solid first-quarter growth. The company’s sales rose 6% year-on-year to 160bn yuan ($22bn). Notably, the firm’s boss, Huateng Ma, reported that 1.36bn people now use Weixin, a social media app also known as WeChat, every month. The company also said it would ramp up buybacks and increase dividends this year.

The American economy is still scorching hot. Durable goods orders rose 0.7% in April, marking the third consecutive monthly increase. And while the inflation rate has fallen, it’s still too high. In a recent speech, Jerome Powell, the chairman of the Federal Reserve, said that the bank expects inflation to return to 2% over the medium term. However, he highlighted that recent data has not increased confidence in reaching that target soon and that the bank is open to raising rates more if they think it’s necessary.

Chinese consumer prices rose 0.3% month-on-month in April, marking the third straight month of inflation in an economy struggling against deflation. Economists blame increased domestic demand. While non-food inflation increased, food prices fell for the tenth straight month.

Sales are falling despite prices rising across Britain. Retail sales fell 2.3% month-on-month in April, the largest fall in four months. Analysts blamed lousy weather, as people stayed at home and didn’t buy as much new clothing. The annual inflation rate also fell, but according to the Bank of England, it is still too high. It dropped to 2.3% in April. ■

How To Value Stocks

My latest book, "How To Value Stocks", is almost ready. This practical guide to figuring out what a company is worth will teach you how to value any public company. It will be available in hardback and paperback. If you want a discount when it's released next month, enter your e-mail address below.

Leader | America’s non-recession

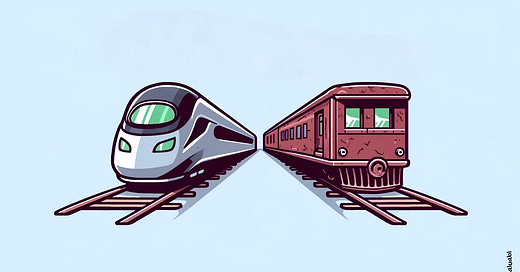

The two-speed economy

The rich are living it up while the poor struggle

Most Americans think the economy is in recession. That's according to research from The Harris Poll, a pollster. A full 56% of Yanks surveyed reckon the economy is shrinking, and they blame Joe Biden, the president. But they're wrong. Overall, the economy is growing—gross domestic product rose 3% year-on-year in the first quarter. There's no recession in sight. So, what's going on? There is a disconnect here because it's a two-speed economy: the rich live it up while the poor struggle. It feels like a recession to many, even though it isn't. And the companies that serve the rich will continue to do better than analysts expect.

Rate hikes have pushed America into this two-speed economy. Wealthy households have more savings and investments than poor ones. Since it's the opposite for credit card debt, higher rates have taken from the poor and given to the rich. The rich have stocked up on risk-free Treasury bonds at higher yields and are raking in the money. Individual investors have increased the size of their Treasury bond holdings five-fold in the past two years. They now own $2.3trn worth. They're receiving about $110bn of extra annual interest income at current rates. That additional income has not only helped soften the blow of higher rates but it's actually fattened their wallets.

On the other hand, low-income households don't have much savings or investment and rely on credit. They've seen their credit card costs explode—annual personal interest payments have doubled in the past two years, rising by $280bn. And since, according to the Federal Reserve, low-earners have much more credit card debt than high-earners, they will have had to cut spending elsewhere to make ends meet. So, even though America's economy has grown, it feels like a recession unless you're rich.

That means rich household spending has grown much more than everyone else's. According to data from the Bureau of Labor Statistics, the bottom fifth of earners spent 30% more per year in 2019 than in 2012. That's double the 15% spending bump the top fifth of earners enjoyed. But, since the pandemic, that relationship has reversed. The lowest earners now only spend 9% more each year while the other end of town spends 22% more. While economy-wide inflation-adjusted spending has increased, your real spending has fallen unless you're in the top 40% of earners. Most low-income households are in a recession.

That also suggests it's boom-time for companies that serve the rich. In contrast, the firms that don't are on Struggle Street. Many luxury goods firms like LVMH, Ferrari and Hermes have reported double-digit sales growth in the past year. And because of their operating leverage, profits have jumped even more. On the other hand, budget-friendly businesses like McDonald's, Starbucks and Target have reported lower sales volumes. These companies provide little luxuries to low-income folk who can't afford them anymore, so they have cut back. The firms that serve the rich will continue to do well if rates remain elevated. Given that sizeable rate cuts are unlikely soon, the economy will continue to operate at two speeds. ■

Letters to the editor

Value in chocolate

I enjoyed the Barry Callebaut write-up (“Barry Callebaut” Vol. 4, No. 2). Thanks for sharing it. Your analysis was clear and convincing, especially about the company's strength despite higher cocoa prices. The points on their pricing model and growth prospects boosted my confidence in considering them as an investment.

— Mark Thompson, Chicago

Immoral logic?

I think the article on why moral investors should own “evil” companies (“Hear no evil, speak no evil, own no evil?” Vol. 4, No. 10) missed the mark. Saying that buying these companies stops bad people from profiting seems off. It ignores the bigger picture and the real harm these businesses can do. Also, the idea that investing in them will make them behave better feels too simple. There are better ways to support ethical practices without backing harmful industries.

— Alice Robinson, San Francisco

Big T energy

Your piece about tech eating the world (“Software is still eating the world” Vol. 4, No. 10) was spot on. Software and AI are taking over, and big tech will keep ruling. Nice work!

— Emma Wilson, Sydney

Reply directly to this email or send your commentary, critiques, and rebuttals to valuabl@substack.com. You can also direct message ValuablOfficial on X. Please include your name and city. Letters may be edited for brevity.

Opinion | Silly GameStop speculators are crying foul, again

No, the market isn’t rigged

There’s no cabal of satanic bankers rigging the market. You just need a better strategy

Earlier this month, shares of GameStop, a video game retailer, rose 219% in just two days. Punters poured into the stock after the X/Twitter account of Keith Gill, the fellow made famous by spruiking the stock during the pandemic, started posting again. The account had laid dormant for the last few years. The flurry of mysterious and nonsensical posts drove speculators wild. But the folks who bought GameStop shares during the two-day hype lost at least half their money in the next three days. Cue the tears. Many of these punters complained that nefarious bankers manipulated the stock market and were out to get them. But is the stock market a scam? No, the stock market isn't rigged. The folks proclaiming it is just got caught up in the moment.