Vol. 4, No. 16 — All-in and chill?

Why you shouldn't go all-in on leveraged ETFs; Stock prices are balancing precariously; China is stockpiling commodities in secret; An e-commerce stock that could double

Contents

The world this fortnight | A summary of economic and financial news

Leader | All-in and chill?

Letters to the editor | On Chinese real estate, leveraged ETFs and political division

Finance | Proceed with caution

Economics | China’s secret commodity stockpiles

Cost of capital | Analysis of the ever-changing price of money

Investment idea | An e-commerce stock that could double

Indicators | Economic data, markets and commodities

The world this fortnight

A botched software update by CrowdStrike, a cybersecurity firm, on July 19th caused a major IT outage, disrupting businesses worldwide. The snafu hit Microsoft Windows equipment, causing thousands of flight cancellations, delayed hospital operations, and temporary bank closures. Some companies will need weeks to recover, and insurers expect losses in the billions. A cyber-attack also caused an outage for Microsoft’s e-mail service and Minecraft game. Delta Air Lines, an American flyer, reported a $500m loss from these disruptions.

Tech companies’ profits are still booming. Alphabet, the company behind Google, reported $84.7bn in revenue for the latest quarter, a 14% increase from last year. Advertising revenues rose 11%, easing investors’ fear of competition from ChatGPT, the artificially intelligent (AI) chat app. Netflix, a video streaming service, also had a strong quarter with a 48% rise in earnings per share and 8m new subscribers. Microsoft, whose earnings don’t yet show the impact of the IT outage, saw a 29% increase in Azure cloud revenue but blamed lower market expectations on AI capacity constraints. Meta, Facebook’s parent company, increased AI spending and settled a $1.4bn lawsuit with the Texas state government over biometric data misuse.

In contrast, Tesla’s quarterly profits were disappointing. The electric car maker reported net income of $1.5bn, below analysts’ expectations of $1.9bn. While revenue rose, operating costs increased much more. Tesla yet again said it will delay launching its self-driving taxi fleet.

The Securities and Exchange Commission (SEC), America’s financial watchdog, approved the first exchange-traded funds (ETFs) to invest in ether, the world’s second-biggest cryptocurrency. This outcome follows the earlier launch of SEC-approved ETFs for bitcoin, offering an alternative investment option in the crypto market.

The eurozone’s gross domestic product (GDP) grew by 1% annually in the second quarter, or by 0.3% compared to the first quarter. However, Germany’s economy shrank again by both measures.

Central bankers in struggling economies cut rates again. The People’s Bank of China cut short and long-term interest rates by 0.1 percentage points. Similarly, the Bank of Canada lowered its policy rate from 4.75% to 4.5%, its second consecutive cut. Canada’s economy is drowning but inflation was still at 2.7% in June, above the bank’s target. Over the pond, the Bank of England cut interest rates for the first time since March 2020. It cut its base rate by a quarter of a percentage point to 5%.

The British pound hit its strongest level against a trade-weighted basket of currencies since the 2016 Brexit vote. Economists reckon faster-than-expected growth and the perceived stability of Britain’s new Labour government drove this strength.

On the other hand, the Bank of Japan raised its benchmark interest rate to 0.25%, the second increase in 17 years. It plans to halve its ¥6trn ($39bn) monthly bond purchases by spring 2026. Japanese officials urged the bank to stop the yen’s decline, as the weakened currency has driven inflation above the 2% target for 27 months.

The Federal Reserve, America’s central bank, kept its main interest rate unchanged but hinted at a possible cut in September. Data showed the American economy grew at an annualised rate of 2.8% in the second quarter, double the 1.4% growth in the first quarter. ■

HOW TO VALUE STOCKS: This new book will teach you how to value any public company, guiding you step-by-step through the process with real-world examples. Whether you’re new to valuation or an experienced investor, this book will help you make better investment decisions.

Leader | Answering a reader’s question

All-in and chill?

It doesn’t make sense to go all-in on a high-leverage version of the Nasdaq index. Here’s why.

In 2010, an American man paid 10,000 bitcoin for two Papa John’s pizzas in the first-ever purchase with bitcoin. Today, those coins would have a market value of almost $650m. Did he overpay? Probably. But, as they say, hindsight is twenty-twenty.

A reader contacted 𝑉𝑎𝑙𝑢𝑎𝑏𝑙 about his colleague’s plan to put all of their money into ProShares UltraPro QQQ (TQQQ), a leveraged version of the Nasdaq 100 index of big American technology companies. The colleague reasoned that since the index has achieved a historical annual return of 40% per year since bankers launched it, they should do well as long as they don’t pull their money out during a drawdown.

But this reasoning didn’t sit well with our reader. He figured it wasn’t a smart move or sound logic but wasn’t sure why. So, should you go all-in on the TQQQ and refuse to sell during a drawdown? No. Apart from that strategy being an elaborate version of a martingale strategy—a betting system in which the gambler doubles his wager every time he loses that statisticians have shown to ruin punters—it’s a high-risk bet that would be impossible for most people to stick to. There are three main reasons why it’s so risky.

First, it’s risky because it uses an extraordinary amount of leverage. The TQQQ is a three-times leveraged version of the Nasdaq 100. ProShares, the company behind the TQQQ exchange-traded fund (ETF), use a combination of futures contracts, options and swaps to magnify the movements in the Nasdaq by a factor of three. That means that if the Nasdaq goes up 1% in a day, the TQQQ surges 3%. But the leverage also magnifies losses. For example, investors in the index lost 79% of their money in 2022 as tech stocks struggled.

Staring down the barrel of losing almost all your money is psychologically brutal, regardless of how resilient you think you are. It would not be easy to ignore. As most men reckon they would win a fistfight, most investors say they can handle volatility—but they can’t. Taking on that sort of leverage would make you do something dumb. It’s easy to say you wouldn’t sell during a drawdown, but the reality would probably be different.

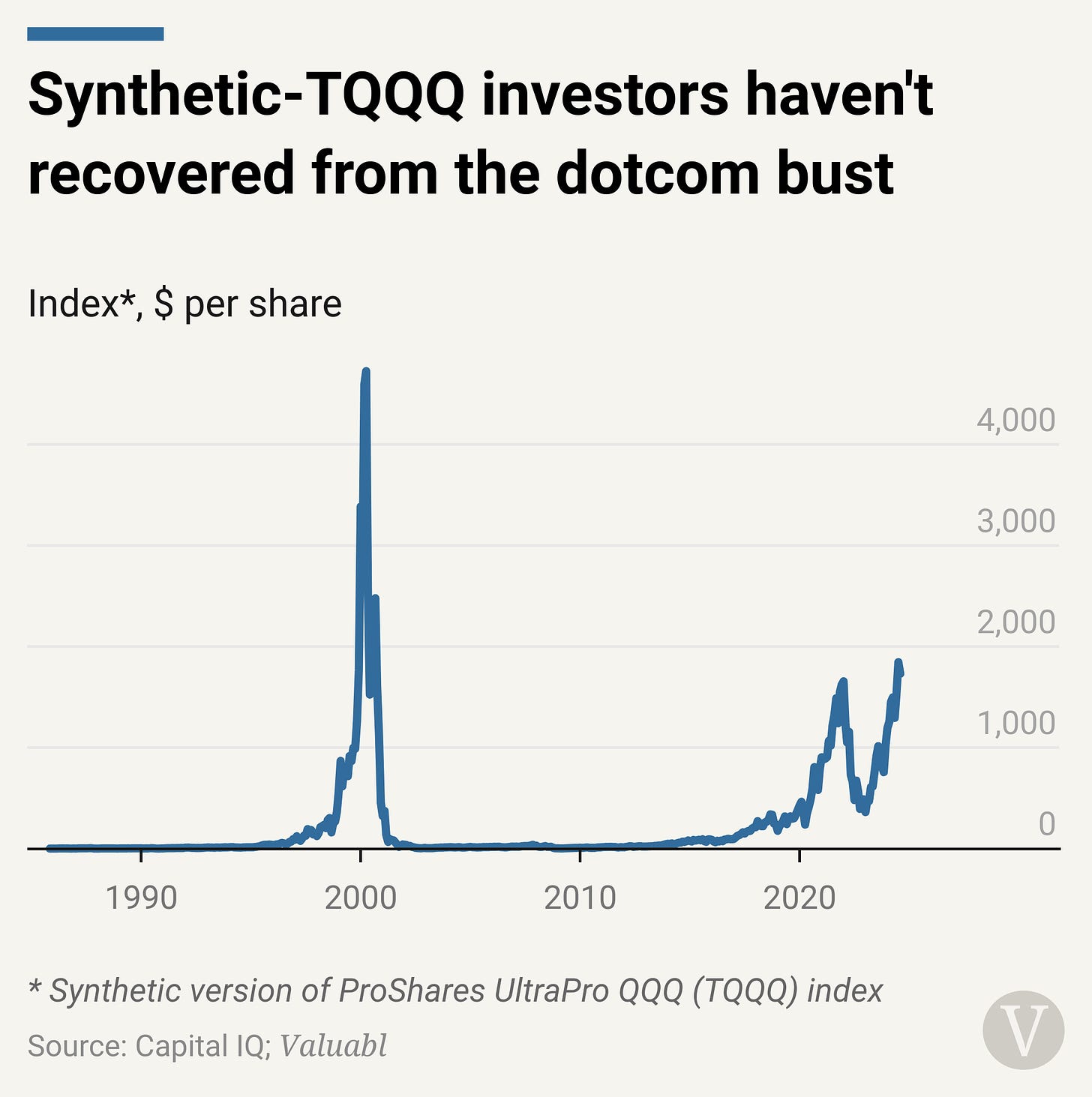

Second, recency bias makes this strategy’s returns look deceptively impressive. Investing in the TQQQ produced a brain-melting 33% compound annual return over the last decade. However, the index has only been around since 2010. Simulating results back to 1985 by scaling up the Nasdaq 100’s returns threefold shows that investors still haven’t recovered from the dotcom bust. Buying at any stage in 1999 or 2000 resulted in a permanent loss to this day. And you’d have had to sit on 99.9% losses for many years. It’s misleading to look at recent history without the long-term context.

Third, the index did well in recent years primarily because technology companies make up most of its stocks. Of the 100 firms in the index, 39 are technology companies, including recent top performers like Nvidia and Tesla. By buying the TQQQ, you’re making a highly concentrated bet on these technology firms. If they do well, you’ll do incredibly well. But, if they do poorly, they’ll crush you. While their shares have done well over the last decade, it increasingly looks like investors have overvalued many. And as the old saying goes, past performance is no guarantee of future results. ■

SPREAD THE LOVE: Share 𝑉𝑎𝑙𝑢𝑎𝑏𝑙 with your friends and colleagues to look like the smartest person they know. You’ll also go into the draw to win a free six-month subscription. The will be one draw every two weeks, and winners will be notified by e-mail.

Letters to the editor

The article “House of Horrors” (Vol. 4, No. 15) presents a bleak yet realistic view of China’s real estate market. However, the analysis could delve deeper into the socio-economic repercussions for Chinese families who are now significantly poorer. The real estate bubble wasn’t just an economic miscalculation but a social disaster. Millions of families whose wealth was tied up in real estate now face an uncertain future. The government’s attempts to prop up the market by buying unsold houses and loosening lending standards are temporary fixes that ignore the need for substantial economic reform. China’s pivot from a real estate-driven economy will be painful, but it must prioritise sustainable growth and social stability over temporary economic boosts.

— James Harrington, Philadelphia

One of my coworkers is talking about putting all his money into TQQQ with the rationale of “if you look at the CAGR since inception it’s 40%, and as long as I don’t pull my money out during any drawdowns and don’t touch it, I’ll be fine.” But I was trying to tell him I don’t think that makes sense. Is it true that if you just had a stomach of steel and didn’t touch it, you would be fine, or is it more complicated because it’s a leveraged product? My gut tells me there would be some complications, but I haven’t confirmed it yet.

— Larson Rice, New York City

While your article on Donald Trump's assassination attempt (“Violent streak“ Vol. 4, No. 15) highlights the disturbing frequency of such attacks, it misses an essential point: the root causes of this violence. Beyond the easy access to weapons, we must consider the deepening polarisation and the rhetoric that fuels division and hatred that he is to blame for. Until we address the underlying societal tensions and promote more constructive dialogue by getting rid of Trump, the tragic trend of political violence is likely to continue.

— Elaine Roberts, Los Angeles

Reply directly to this email or send your commentary, critiques, and rebuttals to valuabl@substack.com. You can also direct message ValuablOfficial on X. Please include your name and city. Letters may be edited for brevity.

Finance | Stocks are overvalued

Proceed with caution

Stock prices look frothy. If corporate profits get wobbly, look out below.

Stock prices have gone gangbusters. The S&P 500 index of big American companies has risen 40% in the last two years. But corporate profits haven’t kept up. In fact, they’ve fallen. The index’s earnings per share has dropped 2% in that time. That bifurcation has some investors worried that the market is in a bubble. So, have investors overvalued the stockmarket? Yes. Stocks look expensive here, and investors should proceed with caution.

On a discounted cash flow basis, the market looks pricey. 𝑉𝑎𝑙𝑢𝑎𝑏𝑙’s model, which uses analysts’ earnings estimates for each company in the index, values the S&P 500 at about 4,900. That’s 15% above the price. Although it’s not a perfect estimate, it suggests investors are giddy. And it’s the most expensive stocks have been since the 2021 market boom. 𝑉𝑎𝑙𝑢𝑎𝑏𝑙’s model estimated that traders had overvalued the market by 15% in September 2021. Subsequently, the market corrected and fell 18% in the following year.